IRS Form 5329-Understanding the Requirement to File

The 2015 Form 5329 is set forth. The title

of this form is, “Additional Taxes on Qualified Plans (including IRAs) and Other Tax-Favored Accounts. Form 5329 is a two page form. The individual tax-payer has the duty to prepare this form. An IRA or HSA custodian does not prepare this form. The title of Form 5329 gives the impression that it is to be filed if there are additional taxes owing.

The fact is, most often it must be filed even when person does not owe an additional tax such as when a person makes an excess IRA or HSA contribution, but corrects it within the appropriate time deadline.

As with other IRS forms, the instructions for Form 5329 are not written as clearly as they should be. The IRS requires the individual to report that he or she has made an excess contribution by completing Form 5329. However, in a number of places, the IRS discusses the tax rule -if a person withdraws some or all of his/her excess contribution for 2015 by the due date of the tax return, as adjusted for earnings or losses and a deduction was not claimed, then the contribution is treated as not having been made. The discussion of the tax rule does not mean the individual does not need to complete Form 5329 to inform the IRS that he or she made an excess contribution.

Note that there are nine sections to this form. Four sections apply to IRAs, three sections apply to Coverdell ESA and ABLE accounts and two apply to HSAs. In general, there is a 10% tax for certain early distributions, a 50% tax for failing to take a required distribution from an IRA and a 6% excise tax for an excess contribution. The 6% tax and the 50% tax apply on an annual basis. If a person makes an excess contribution in 2014 and it is not corrected in 2014 or 2015, then the 6% tax is owed for both 2014 and 2015. Similarly, if a person fails to take his 2014 RMD in either 2014 or 2015, then the 50% tax is owed for both years.

Individuals will make excess IRA contributions and excess HSA contributions. An excess contribution is one not permitted by the IRA rules or the HSA rules. An annual contribution may be an excess contribution. A non-qualifying rollover contributions an excess contribution. An impermissible transfer contribution may be an excess contribution.

The purpose of this article is to discuss the reporting duties of the individual and the IRA/HSA custodian when an excess IRA or HSA contribution has been made. It is true that a person who corrects his or her excess contribution by withdrawing it as adjusted for earnings or losses will have minimal adverse tax consequences. However, IRS procedures require that the individual complete the applicable section of Form 5329 to indicate that he or she made an excess contribution and it was either corrected with no tax penalty owing or it was not correct and the tax penalty is owed. The individual is not allowed to adopt the approach, “I corrected the

excess contribution by withdrawing it so I am able to skip preparing and filing the Form 5329.” The rules require an individual who has made an excess IRA or HSA contribution (or the employer made it) to complete the applicable section of Form 5329. In preparing the Form 5498 or Form 5498-SA, the IRA custodian or HSA custodian must report ALL contributions made by (or on behalf of) the individual. There is no netting of contributions. Note that the IRS has no procedure for the IRA/HSA custodian to indicate on the Form 5498 or Form 5498-SA that the individual has made an excess contribution. This approach is consistent with the IRS’ administrative approach that the general duty to determine if an excess contribution has been made belongs to the IRA accountholder or HSA owner and is not the duty of the IRA/HSA custodian.

Who must file the 2015 Form 5329?

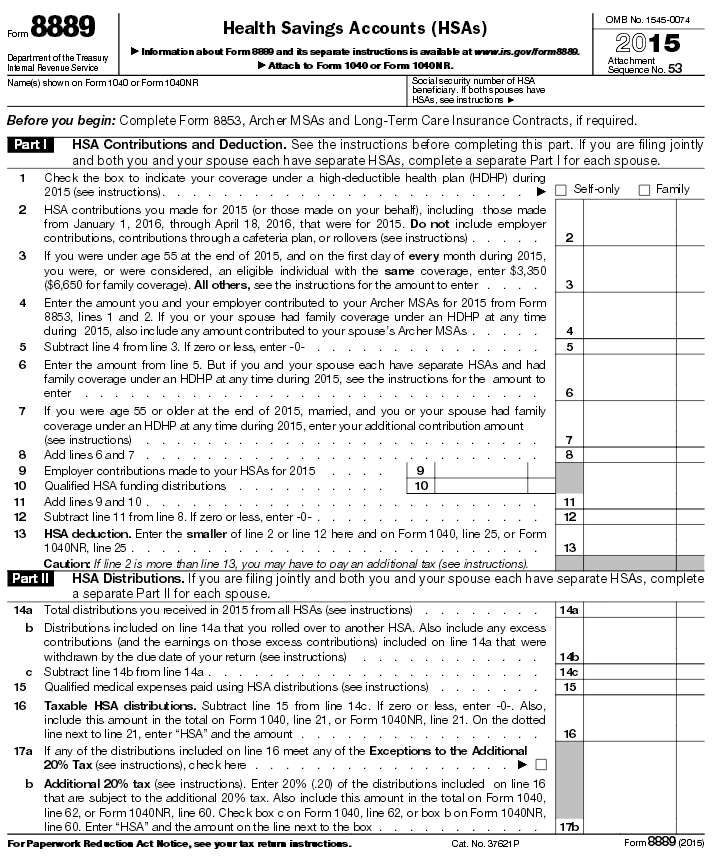

Note that Part VII of Form 5329-Additional Tax on Excess Contributions to HSAs is to be completed if a person (or the person’s employer) made an excess HSA contribution for 2015 or the person owed the 6% excise excess contribution tax for 2014. The individual must also report his or her withdrawal of the excess contribution on Form 8889 (HSAs). In Part II on line 14a the total amount of HSA distributions is shown. A distribution used to pay a qualified medical expense is tax-free. A distribution not used to pay a qualified medical expense must be included in income (and taxes paid) and a 20% penalty tax is owed if the individual is not age 65 or disabled. The withdrawal of an excess contribution does not belong to either such category. So, line 14b is completed to show the withdrawal of all 2015 excess contributions plus earnings. The remaining amount is then either “qualified” or non-qualified. In summary, an HSA owner must complete Form 5329 to show that he or she (or the employer) made an excess HSA contribution. This is true even if the individual corrected the excess by withdrawing it.