« RMDs | Main | Self-Directed IRAs »

Monday, October 31, 2016

IRA Contribution Limits for 2017 – Unchanged at $5,500 and $6,500; 401(k) Limits Unchanged Also

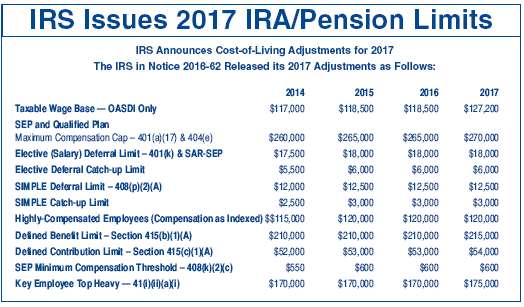

Inflation was approximately .3% for the fiscal quarter ending September 30, 2016, so many of the IRA and pension limits as adjusted by the cost of living factor have not changed or the changes have been quite small.

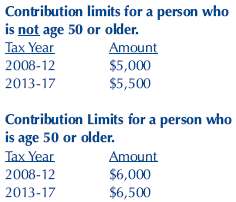

The maximum IRA contribution limits for 2017 for traditional and Roth IRAs did not change – $5,500/$6,500.

The 2017 maximum contribution limit for SEP-IRAs is increased to $54,000 (or,25% of compensation, if lesser) up from $53,000. The minimum SEP contribution limit used to determine if an employer must make a contribution for a part-time employee remains the same at $600.

The 2017 maximum contribution limits for SIMPLE-IRAs is unchanged at $12,500 if the individual is under age 50 and$15,500 if age 50 or older.

The 2017 maximum elective deferral limit for 401(k) participants is unchanged at $18,000 for participants under age 50 and $24,000 for participants age 50 and older.

Edited on: Tuesday, November 08, 2016 14:21.07

Categories: Pension Alerts, Roth IRAs, SIMPLE IRAs, Traditional IRAs

Wednesday, April 20, 2016

IRS Biased Against Inherited Roth IRAs

The IRS should not be biased against inherited Roth IRAs, but the IRS is. Some IRS administrations are more biased against inherited Roth IRAs than others.

The IRS does not like the fact that a person may inherit a Roth IRA and earn tax-free income over the beneficiary’s life expectancy. This will be accomplished if the beneficiary limits his or her distributions to the required amount each year using the life distribution rule. This will not be accomplished if the 5-year rule is used.

The IRS last revised model Form 5305-RA in March of 2002. In Article V it is clearly stated that a beneficiary will use the life distribution rule to comply with the required distribution rules unless he or she elects the 5-year rule. The 5-year rule applies automatically if there is no designated beneficiary (e.g. the estate is the beneficiary).

Article V

1. If the depositor dies before his or her entire interest is distributed to him or her and the depositor’s surviving spouse is not the designated beneficiary, the remaining interest will be distributed in accordance with (a) below or, if elected or there is no designated beneficiary, in accordance

with (b) below:

(a) The remaining interest will be distributed, starting by the end of the calendar year following the year of the depositor’s death, over the designated beneficiary’s remaining life expectancy as determined in the year following the death of the depositor.

(b) The remaining interest will be distributed by the end of the calendar year containing the fifth anniversary of the depositor’s death.

The IRS in Publication 590-B (Distributions from IRAs), page 36, gives murky guidance discussing distributions after the Roth IRA owner’s death. “Generally, the entire interest in the Roth IRA must be distributed by the end of the fifth calendar after the year of the owner’s death unless the interest is payable to a designated beneficiary over the life or life expectancy of the designated beneficiary.” The IRS could and should be informing a Roth IRA beneficiary that if he or she elects to use the 5-year rule that one loses the right to earn tax-free income and therefore most beneficiaries should use the life distribution rule.

In recent years the IRS has adopted rules and procedures to be more fair and transparent. At times the IRS has a great conflict of interest and should make this known. The IRS should revise its discussion of inherited Roth IRAs to not try to induce a beneficiary to use the 5-year rule.

Wednesday, July 15, 2015

Roth IRA Conversions, Is it Worthwhile For a Person to Change State of Residence Before Converting ?

For most individuals it will not be worth the effort or the inconvenience to change their state of residence prior to doing a Roth IRA conversion contribution. For others, not having to pay state income tax on the conversion will make it worthwhile.

When one converts the funds within his traditional IRA to a Roth IRA, he will include the taxable amount in his income for federal income tax purposes.

What about state income tax? Individuals residing in states with incomes taxes will also need to pay state income tax on the amount converted if they reside in a state that assesses an income tax. For some, this may be substantial as the highest tax rate is the following in: ( California-13.3%, Hawaii- 11.01%, Oregon-9.9%, Minnesota- 9.85%, Iowa - 8.98%, New Jersey- 8.97%, New York-8.82%, etc.).

For example: An individual residing in California, New York, Michigan, Minnesota, Iowa or any other state with an state income tax may wish to move to a state with no income tax ( Texas, Florida, Tennessee, Nevada, Wyoming, Washington, and South Dakota. ) for the period required under the various state laws to avoid paying the state income tax with respect to his Roth IRA conversion.

For most individuals it will not be worth the effort or the inconvenience, but for others the tax savings will make it worthwhile to move to a state without a income tax for a certain time period so that the individual may convert his or her Roth IRA and avoid paying state income tax. Under current laws, a person could return to his “home” state later after doing the conversion while residing in another state. Time will tell if these states will enact laws giving them the right to try to tax such funds even though the conversion had occurred when a person was a non-resident.

Friday, January 10, 2014

Faulty IRA Information – Roth IRA Article From Certain Investment Firm and the Two Roth IRA 5-Year Rule(s)

IRAs hold over 27% of all retirement plan assets in the United States. People are and should be writing about IRAs. Some articles, including brochures, will sometimes contain errors. A certain investment firm has recently sent a fax to some financial institutions discussing Roth IRAs and some incorrect statements were made. Your institution may have been sent the fax.

November and December are month when some traditional IRA owners decide they are going to do a Roth IRA conversion. Within this article we do not directly name the investment firm, but it is a major firm. The main error within the article is to state that there is always a separate 5-year time period for each distinct Roth IRA conversion contribution.

Why this newsletter article? Many times a CWF client will call us and ask, “why does this article state the tax rules differently than what you have previously told us?”

CWF’s answer is, let us review what you are reading and let us make a determination if we are wrong in our understanding of the tax rules or if the investment firm is wrong?

There are actually two 5-year rules which may apply to a Roth IRA distribution. You, your customer, and their advisors want to understand both rules.

The first 5-year rule relates to whether the distribution of income from a Roth IRA will be taxable or not taxable. There is only one 5-year time period for this 5-year rule.

The second 5-year rule relates to whether a person who is under age 59½ when he or she does a conversion will owe the 10% additional tax if he or she takes a subsequent withdrawal from the Roth IRA before he or she has met a second 5-year requirement. For this purpose, there is a 5-year time period determined for each conversion. When a person under age 59½ does a conversion, he or she does NOT owe the 10% additional tax as generally applies when a person is not yet age 59½.

If there was no requirement to leave the converted funds in the Roth IRA for a certain time period after the conversion, any person under age 59½ who wanted to take money from his or her traditional IRA would first convert it to a Roth IRA and then take the distribution from the Roth IRA to avoid the 10% tax.

The lawmakers could have decided on any time period: 3-years, 6-years, 10-years, but 5-years was selected. Having two different 5-year rules is confusing.

The 10% additional tax is not owed by a person who has done a conversion once he or she attains age 59½ or meets the 5-year rule with respect to that particular conversion. For example, a person who is age 57 at the time of the conversion is subject to the 5-year rule and also the 10% additional tax for any distribution he or she would take between age 57 and 59½. The 10% tax is not owed once a person attains age 59½.

Below are various incorrect statements made in the article:

“Unlike the 5-year rule that applies to contributions, the 5-year rule applies to each conversion separately; each conversion has it’s own 5-year waiting period before a qualified distribution may occur.” These two statements are categorically incorrect.

Error #1. The 5-year rule does NOT apply to each conversion separately. Reg. 1.408A-6, Q/A-2 provides there is only one 5-year period for both annual and conversion contributions. The IRS regulation provides, “The 5-taxable year period begins on the first day of the individual’s tax year for which the regular contribution is made to any Roth IRA of the individual or, if earlier, the first day of the individual’s tax year in which a conversion is made to ANY Roth IRA of the individual. The 5-taxable year period ends on the last day of the individual’s fifth consecutive tax year beginning with the tax year discussed in the preceding sentence.”

Error #2. The article states the the 5-year rule applying to “annual” contributions is different from the 5-year rules applying to a conversion contribution. The regulation indicates the 5-year period may be different, but it need not be. For example, a conversion made on December 2, 2013, means the 5-year period begins on January 1, 2013 whereas an annual contribution made on March 1, 2014, for 2013 will also have a 5-year period which begins on January 1, 2013

“Recharacterization is only available in connection with converting amounts into a Roth IRA. It is not available for conversions within a qualified plan.” This is not well-written. It is true a qualified plan participant who converts taxable funds into a Designated Roth account cannot recharacterize such conversion. However, the first sentence is wrong because a person is permitted to recharacterize an annual contribution by going from a traditional IRA to a Roth IRA or going from a Roth IRA to a traditional IRA.

The statement is also made that “IRA conversions can be recharacterized up to October 15 of the year following the conversion.” Not everyone qualifies for this extended deadline. The actual law is, a person has until April 15 of the following year to recharacterize a contribution (be it a conversion or an annual contribution). However, if a person filed his or her tax return by April 15 and paid any tax owing, then he or she is given until October 15 to complete the recharacterization.

CWF’s explanation is consistent with IRS guidance as set forth in the Regulation 1.408(A) and IRS Publication 590. See Q&A’s 2 and 5 of the regulation. Any article on Roth IRA distributions should explain that the law mandates that distributions come out in the following order: annual contributions, the conversion contributions in order of time (oldest come out first), and then earnings come out last. A person never owes income tax when he or she withdraws a contribution (annual contribution or a conversion contribution) because such contributions were made with after-tax funds.

A person never owes income tax when he or she withdraws the income or the earnings and the distribution is “qualified.” A person does owe income tax on the earnings when he or she withdraws the earnings and the distribution is NOT qualified (e.g. not 59½ or 5- year rule not met). And if this person is under age 59½, he or she will owe the 10% additional on such earnings.

In summary, the investment firm’s Roth IRA article contains a number of errors. In 1999 the law was changed so that there is only one 5-year time period for purposes of determining whether nor not a Roth IRA distribution is qualified (tax-free) or not. Believe it or not, everyone should congratulate the lawmakers as they did try to simplify the tax calculation. The original law effective only for 1998 would have required a person to have separate 5-year time periods for Roth IRA conversion contributions versus annual Roth IRA contributions for purposes of whether the income was taxable or not.

Edited on: Monday, April 14, 2014 15:50.45

Categories: Pension Alerts, Roth IRAs

Thursday, September 26, 2013

Can't Directly or Indirectly Rollover a Roth IRA to a 401(k) Plan.

401(k) participants sometimes wonder if they can and should move their Roth IRA funds into their 401(k) plan. Current tax law does not authorize a person to move their Roth IRA funds into their employer’s 401(k) even if the 401(k) plan authorizes Designated Roth contributions. The 401(k) plan does not authorize such a rollover because current law does not authorize this movement as being nontaxable.

Maybe the law will permit this someday, but not at the present time.

There will be a tax mess both for the 401(k) plan and the individual if such a rollover is made. Most likely the IRS would NOT allow the Roth IRA funds to be returned to the Roth IRA if the 60-day period to complete a rollover has expired. The person might try to argue that he or she received poor advice from an advisor, but there is going to come a time when the IRS will not so readily accept this argument. The IRS will make the argument – you withdrew the funds from your Roth IRA and you did not complete a timely rollover; your funds are no longer entitled to be returned to the Roth IRA. Such a distribution may or may not have any current income tax consequences. What is known, such funds will not earn tax-free income as would have been the case had they stayed in the Roth IRA.

- Chlamydial Infection

- Gonorrhea

- Hepatitis B Virus Infection

- Hepatitis

- Human Immunodeficiency Virus (HIV) Infection

- Syphilis

- Tuberculosis Infection

- Mental Health Conditions and Substance Abuse Screening

- Dementia

- Depressio

- Drug Abuse

- Problem Drinking

- Suicide Risk

- Family Violence

- Metabolic, Nutritional, and Endocrine Conditions Screening

- Anemia, Iron Deficiency

- Dental and Periodontal Disease

- Diabetes Mellitus

- Obesity in Adults

- Thyroid Disease

- Musculoskeletal Disorders Screening

- Osteoporosis

- Obstetric and Gynecologic Conditions Screening

- Bacterial Vaginosis in Pregnancy

- Gestational Diabetes Mellitus

- Home Uterine Activity Monitoring

- Neural Tube Defect

- Preeclampsia

- Rh Incompatibility

- Rubella

- Ultrasonography in Pregnancy

- Safe Harbor Preventive Care Screening Services — Continue

- Pediatric Conditions Screening

- Child Developmental Delay

- Congenital Hypothyroidis

- Lead Levels in Childhood and Pregnancy

- Phenylketonuria

- Scoliosis, Adolescent Idiopathia

- Vision and Hearing Disorders Screening

- Glaucoma

- Hearing Impairment in Older Adults

- Newborn Hearing

Edited on: Monday, April 14, 2014 15:49.13

Categories: Pension Alerts, Roth IRAs

Moving Non-deductible Funds from a 401(k) Plan Into a Roth IRA.

This article discusses moving basis within a 401(k) plan or a profit sharing plan into a Roth IRA.

A customer wanting to make a direct rollover or rollover contribution of pension funds containing basis should always be advised to consult with his or her tax advisor as this is complicated tax subject. One reason is – the IRS has not been willing to give definitive written guidance.

Discussion of a hypothetical situation is helpful. Let’s assume Jane Doe has a 401(k) balance of $50,000, it is comprised of two portions – $40,000 (deductible/taxable contributions and earnings) is taxable and $10,000 is nontaxable (i.e. basis).

Is it possible for Jane to directly rollover the $40,000 of taxable money in the 401(k) plan to a traditional IRA and then directly rollover (i.e. convert) the $10,000 of basis into a Roth IRA?

No. When there is a direct rollover or direct rollovers the pro-rata taxation rule will not allow only the basis to go into the Roth IRA. That is, if $10,000 goes into the Roth IRA, $8,000 of it will be taxable and $2,000 will be nontaxable under a direct rollover approach. Jane will include the $8,000 in her income and pay tax on it. This means she will still have $8,000 of basis with the traditional IRA.

This is not the result she wants. She wants to have no basis within the traditional IRA and she wants only basis to go into the Roth IRA so she will not have to pay any income tax.

Is there an approach allowing Jane to pay no tax with respect to the $10,000 she puts into her Roth IRA?

Yes, but she will need to have access to some additional funds ($8,000) as explained below.

Jane will need to instruct the 401(k) administrator that she wishes to have her plan balance of $50,000 paid to her in cash. She cannot do a direct rollover and achieve the desired result. Since she is paid cash, the plan administrator will withhold 20% of the taxable amount of the distribution. The plan will give her a check for $42,000. 20% must be withheld from the $40,000 or $8,000. 0% must be withheld with respect to the basis (i.e. her own nondeductible contributions). Thus, she is paid $42,000 ($32,000 + $10,000).

Jane now has 60 days to rollover this $42,000 distribution. She may do so by making multiple rollover contributions. First, she wants to rollover the $40,000 into her traditional IRA. Later, she wants to rollover the $10,000 into her Roth IRA. Since she only has $2,000 as the other $8,000 was withheld, she will need to add her own $8,000 to make the $10,000 rollover. This $8,000 can come from other personal funds or possibly from a loan.

Why must she do it this way? Code section 402(c)(2) provides that when a person has basis within the 401(k) plan and takes a distribution, that the taxable amount comes out first and the nontaxable amount comes out second. Because of this rule, she may make a roll over contribution of $40,000 to her traditional IRA and then a rollover contribution of $10,000 to her Roth IRA. The $10,000 she contributes to her Roth IRA will be her basis or the nontaxable amount. In this situation, the pro-rata rule is not used. Although asked numerous times, the IRS has not confirmed that this approach works so that all of the $10,000 going into the Roth IRA is basis and nontaxable.

Edited on: Monday, April 14, 2014 15:49.54

Categories: Pension Alerts, Roth IRAs

Tuesday, May 14, 2013

Military Death Gratuity and Service-members Group Life Insurance Payment and Roth IRAs.

A special type of rollover contribution is authorized. If a person receives a military death gratuity or a payment from Servicemembers’ Group Life Insurance (SGLI), this person may roll over all or part of the amount received to his or her Roth IRA. Such payments are made to an eligible survivor upon the death of a member of the armed forces.

If you are the person and you are a member of the decedent’s family, then you may make a rollover contribution to your Roth IRA. The maximum amount eligible to be rolled over is the total of the survivor benefits less any amounts already rolled over on your behalf of another family member’s behalf to a Roth IRA or other Coverdell ESAs. The amount of survivor benefits contributed to the Roth IRA will be basis and will not be taxed when withdrawn.

This special rollover must be completed within one year after the date the individual received the death benefit gratuity or the SGLI payment. The once per year rollover limit applying during a 12-month period does not apply to rolling over a military death gratuity or a SGLI payment.

This special rollover is not subject to the annual contribution limits applying to Roth IRA contributions.

Edited on: Monday, April 14, 2014 15:42.58

Categories: Pension Alerts, Roth IRAs, Traditional IRAs

Thursday, October 18, 2012

IRS Announces 2013 Limits for IRAs and Pension Plans

IRS Announces 2013 Limits For IRAs and Pension Plans

Today, the IRS announced to 2013 limits applying to IRAs and pension plans by issuing IRS news release 2012-77.

The IRA contribution limits are changed - $5,500 (up from $5,000) if the individual is younger than age 50 in 2013, and $6,500 (up from $6,000) if he or she attains age 50 or older in 2013.

The maximum SEP contribution for 2013 will increase to $51,000 from $50,000.

The SIMPLE IRA contribution limits are also changed for 2013. The maximum elective deferral contribution amount is $12,000 for a person who is younger than age 50 in 2013 and $14,500 if he or she attains age 50 or older in 2013.

The 401(k) elective deferral contribution limits also changed for 2013. The maximum elective deferral contribution amount is $17,500 (up from $17,000) for a person who is younger than age 50 in 2013 and $23,000 (up from $22,500) if he or she attains age 50 or older in 2013.

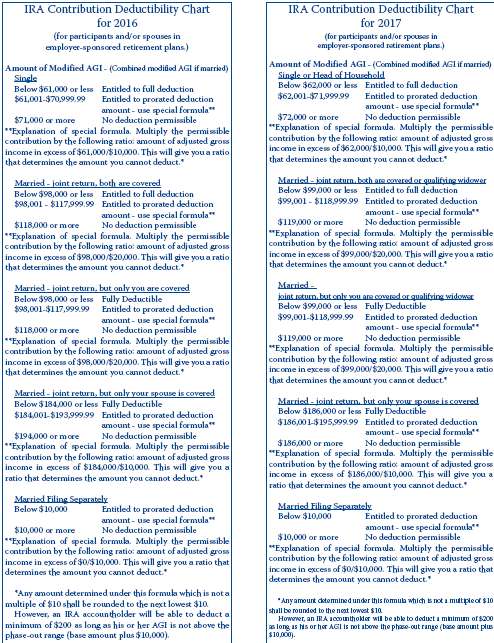

The compensation ranges applying to deductible IRA contributions do increase.

- The 2013 compensation range applying to a person whose filing status is single, head of household or qualifying widower is ($59,000 - $69,000) (up from $58,000 - $68,000}

- The 2013 compensation range applying to a person whose filing status is married/joint return and an active participant is ($95,000 - $115,000) (up from $92,000 - $112,000}

- The 2013 compensation range applying to a person whose filing status is married/joint return but not an active participant is ($178,000 - $188,000) (up from $173,000 - $183,000}

- The 2013 compensation range applying to a person whose filing status is married but filing a separate return is unchanged at ($0 - $10,000).

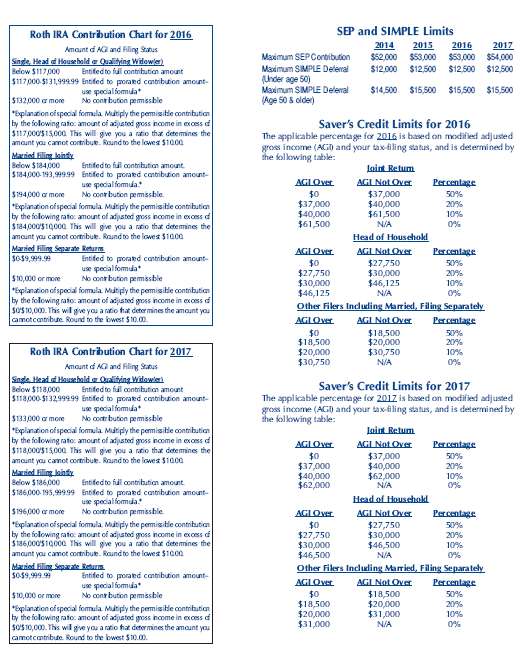

The compensation ranges applying to Roth IRA contributions have increased for 2013.

- The 2013 compensation range applying to a person whose filing status is single, head of household or qualifying widower is ($112,000 - $127,000) up from ($110,000 - $115,000)

- The 2013 compensation range applying to a person whose filing status is married/joint return is ($178,000 - $188,000) up from ($173,000 - $183,000)

- The 2013 compensation range applying to a person whose filing status is married but filing a separate return is unchanged at ($0 - $10,000).

The compensation ranges applying to a savers tax credit also will increase.

Edited on: Monday, April 14, 2014 15:36.28

Categories: Governmental Reporting, Pension Alerts, Roth IRAs, Traditional IRAs