« Health Savings Accounts | Main | RMDs »

Monday, October 31, 2016

IRA Contribution Limits for 2017 – Unchanged at $5,500 and $6,500; 401(k) Limits Unchanged Also

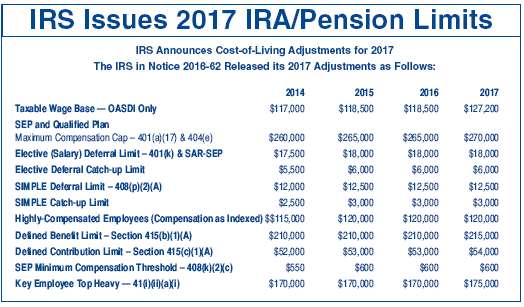

Inflation was approximately .3% for the fiscal quarter ending September 30, 2016, so many of the IRA and pension limits as adjusted by the cost of living factor have not changed or the changes have been quite small.

The maximum IRA contribution limits for 2017 for traditional and Roth IRAs did not change – $5,500/$6,500.

The 2017 maximum contribution limit for SEP-IRAs is increased to $54,000 (or,25% of compensation, if lesser) up from $53,000. The minimum SEP contribution limit used to determine if an employer must make a contribution for a part-time employee remains the same at $600.

The 2017 maximum contribution limits for SIMPLE-IRAs is unchanged at $12,500 if the individual is under age 50 and$15,500 if age 50 or older.

The 2017 maximum elective deferral limit for 401(k) participants is unchanged at $18,000 for participants under age 50 and $24,000 for participants age 50 and older.

Edited on: Tuesday, November 08, 2016 14:21.07

Categories: Pension Alerts, Roth IRAs, SIMPLE IRAs, Traditional IRAs

Wednesday, September 28, 2016

Financial Institution Must Notify DOL It Will Use BICE And Must Comply With Record Keeping Requirements

In order to use the BICE a financial institution must notify the DOL by providing an email to e-bice@dol.gov that it will to use the BICE. The notice can be generic. That is, it need not mention any specific IRA or any specific plan. If the notice requirement has been met, then the financial may receive compensation. The notice remains in effect until it would be revoked by the financial institution.

The financial institution must maintain for six years the records necessary for certain persons to determine whether the conditions of the BICE have been met with respect to each specific transaction. Upon request the following individuals must have the right to exam these records during normal business hours:

- Any authorized employee or representative of the IRS

- Any plan fiduciary which has participated in an investment transaction pursuant to the BICE

- Any authorized employee or representative of a plan fiduciary which has participated in an investment transaction pursuant to the BICE

- Any contributing employer and any employee organization whose employees or members are covered by the plan

- Any authorized employee or representative of a contributing employer and any employee organization which has participated in an investment transaction pursuant to the BICE

Any IRA owner or plan participant or inheriting beneficiary or an authorized representative of such persons.

None of the non-IRS individuals are authorized to examine records regarding a recommended transaction of another retirement investor, privileged trade secrets or privileged commercial or financial information of the financial institution or information identifying other information.

When a financial institution refuses to furnish requested information for a reason state above, it has 30 days in which to inform the requester of the reasons for denying the request and that the DOL if requested could request such information.

If the required records are not maintained, there is a loss of the exemption only for that transaction or transactions for which the records are missing or have not been maintained. Other transactions will still qualify for the BICE if those records are maintained. If the records are lost or destroyed, due to circumstances beyond the control of the financial institutions, then no prohibited transaction will be considered to have occurred solely on the basis of the unavailability of those records.

The financial institution is the party who is responsible to pay the ERISA civil penalty under section 502 or the taxes under section 502 or the taxes under section 4975 if the required records are not maintained

Edited on: Tuesday, November 08, 2016 14:20.33

Categories: Pension Alerts, Traditional IRAs

Wednesday, September 21, 2016

Election Day November 8th, 2016 and the Politics of IRAs.

You and other voters will go the voting booth on November 8th, 2016.

IRAs are political because they are created by the federal income tax laws. IRA owners receive tax preferences for making various types of IRA contributions or because the IRA has received a direct rollover or rollover contribution from a 401(k) plan or another employer sponsored retirement plan.

The federal deficit is a political issue waiting to be addressed. More and more politicians are starting to seriously look at IRAs and 401(k) plans as sources of tax revenues. Money in traditional, SEP and SIMPLE IRAs is tax deferred, it is not tax-free. When distributed or withdrawn, the distribution amount must be included in the recipient's income and tax paid at the person's applicable marginal income tax rate.

There is approximately 7.2 trillion dollars in traditional IRAs. Assuming an average marginal tax rate of 20% the federal government is looking to collect 1.4 trillion dollars from future IRA distributions. There is approximately 6.8 trillion dollars in 401(k) and other defined contribution plans. Assuming an average marginal tax rate of 20% the federal government is looking to collect 1.3 trillion dollars from future 401(k) distributions. The federal debt is estimated to be 19.5 trillion dollars as of September 30, 2016. IRAs and 401(k) plans cover 13.8% of the federal debt.

The question is, when will these tax revenues be collected?

Some politicians are starting to suggest the IRA rules need to be changed so the federal government starts to collect tax revenues sooner than under existing law.

Senator Ron Wyden represents the State of Oregon. He is a Democrat. There is a 50% chance he will become the chairman of the Senate Finance Committee in 2017 after the November 8th elections. He recently communicated that he and other Democrats will be pursuing the following IRA law changes.

- With respect to inherited IRAs, the 5-year rule would apply once an IRA owner dies. This would be a monumental change. A traditional IRA beneficiary would have 5-6 years to take distributions, include such amounts in income and pay tax. The ability to stretch out distributions over the beneficiary's life expectancy would be repealed. A Roth IRA beneficiary would lose the right to have the Roth IRA earn tax-free income for a period equal to his or her life expectancy. The beneficiary would be given only 5-6 years of tax-free income

-

It is unclear if everyone would lose the right to make Roth IRA

conversion contributions or if a person with traditional IRA funds

could make a conversion contribution but only to the extent the IRA

funds are taxable. That is, a person with basis in his/her IRA or

pension plan could not convert any basis. The Obama administration has

previously proposed not allowing basis within an IRA to be converted.

A total repeal of the right to make a Roth IRA conversion contribution

would be radical.

At least on a short term basis, the federal government likes it when individuals make Roth IRA conversion contributions as tax revenues are collected.

- There would be a new tax rule stipulating that the maximum value of a person's Roth IRAs would be limited to $5,000,000 and if this limit was exceeded then the excess would have to be withdrawn. This also would be a radical change.

- A non-IRA change would be to change the law governing 401(k) plans. Somehow a person making student loan payments would be given credit under their 401(k)plan so that the loan payments would be treated as an elective deferral contributions so that an employer would have to make a matching contribution.

In summary, IRAs are political. As with other political subjects, each person will need to make their own voting decisions. Taking away IRA tax preferences is in essence a tax increase and individuals will need to decide the degree it will influence how they will vote. We at CWF believe switching to the 5-year rule for an inherited IRA beneficiary should be unacceptable.

Edited on: Tuesday, November 08, 2016 14:20.16

Categories: Pension Alerts, Traditional IRAs

Monday, August 15, 2016

IRS Issues Additional Procedure For Waiver of 60-Day Rollover Requirement and Additional Self-Certification Procedure

The IRS issued Revenue Procedure 2016-47 on August 24, 2016. It modifies Revenue Procedure 2003-16. The IRS now in the course of a examining a taxpayer’s individual tax return may determine that the person qualifies for a waiver of the 60-dayrollover requirement.

The IRS has created a third waiver method. The new waiver method is effective on August 24, 2016. The first waiver method set forth in Revenue Procedure 2003-16 requires the taxpayer to file an application requesting a waiver of the 60-day rule and the IRS must grant the waiver. The second waiver method authorizes an automatic waiver of the 60-day rule if four requirements are met.

Why this new IRS procedure?

In January of 2016 the IRS changed

the filing fees that a taxpayer must pay when submitting his or her

waiver application. In 2015, the filing fee was $500 if the purported

rollover was less than $50,000, $1,500 if the rollover amount was less

than $100,000 but equal to or more than $50,000 and $3,000 if the

rollover amount was $100,000 or more.

The IRS increased the fee to $10,000 for all such waiver applications. Apparently the IRS concluded that it no longer could afford to assign the personnel it had assigned to process these waiver requests. Presumably, many taxpayers and tax professionals have expressed their dissatisfaction to the IRS. The $10,000 filing fee means many taxpayers are no longer able to have the IRS process their application and receive a concrete ruling that they were or were not entitled to a waiver of the 60-day rule. The application process provided a taxpayer with tax certainty.

In Revenue Procedure 2016-47 the IRS authorizes a self-certification procedure that a taxpayer may use to request the waiver of the 60-day requirement rather than using the application procedure.The IRS tentatively grants the waiver upon the making of the self-certification and the taxpayer is permitted to prepare his or her tax return to reflect that he or she made a complying rollover so the distribution amount is not required to be included in his or her taxable income. However, the IRS retains the right to examine the individual’s tax return for such year (i.e. Audit) and determine if the requirements for a waiver of the 60-day rule were or were not met. If the IRS determines the individual was not entitled to a waiver of the 60-day rule, the individual will have to include such distribution in his or her income and will have an excess IRA contribution situation needing to be corrected. The IRS explanation gives a limited discussion of the adverse consequences. If the IRS does not grant the waiver then the person may be subject to income and excise taxes, interest and penalties. One of the penalties which might apply would be the 25% tax for understating one’s income.

This self-certification procedure applies to distributions from any type of IRA and also from a 401(k) plan or other qualified plan and certain 403(b) and 457 plans.

The IRS has stated that it will be modifying the Form 5498 so that an IRA custodian which accepts a rollover contribution pursuant to this self-certification procedure after the 60-day deadline will complete such person’s Form 5498 to report that the rollover contribution was accepted after the 60-day deadline. The IRS will then be able to examine the tax returns of these taxpayers and the purported rollovers.

How does this self-certification procedure work?

The IRA owner

will furnish the IRA custodian/trustee with a written certification

meeting the following requirements. The IRA owner may use the IRS’ model

letter set forth in the appendix of Revenue Procedure 2016-47 on a

word-for-word basis or by using a form or letter that is substantially

similar in all material respects.

The requirements:

- The IRS must not have previously denied a waiver with respect to a rollover of all or part of the distribution involved in the late rollover

- The IRA owner must make his or her rollover contribution as soon as practicable once the reason(s) for missing the 60-day deadline no longer apply. This requirement is deemed satisfied if the rollover contribution is made within 30 days after the reason or reasons no longer prevent the IRA owner from making the rollover contribution.

- The taxpayer must have missed the 60-day deadline for one or more of the following reasons:

- An error was committed by the financial institution making the distribution or receiving the contribution

- The distribution was in the form of a check and the check was misplaced and never cashed

- The distribution was deposited into and remained in an account that you mistakenly thought was a retirement plan or IRA

- Your principal residence was severely damaged

- One of your family members died

- You or one of your family members were seriously injure

- You were incarcerated

- Restrictions were imposed by a foreign country

- A postal error occurred

- The distribution was made on account of an IRS levy and the proceeds of the levy have been returned to you

- The party making the distribution delayed providing information that the receiving plan or IRA required to complete the rollover despite my reasonable efforts to obtain the information.

A person whose reason for missing the 60-day requirement is not included in the list of reasons is unable to use this self-certification procedure. The IRA custodian is authorized to rely on the IRA owner’s self-certification for purposes of accepting the rollover and reporting it unless it has actual knowledge contrary to the self-certification.

The IRS has created this self-certification method because it had to have some alternative procedure to allow taxpayers to seek a waiver of the 60-day rule as discussed in Revenue Procedure 2003-16 as the increased filing fee meant most taxpayers no longer would be using the application process.

This new procedure will help some taxpayers, but it would not have been needed if the IRS would not have imposed the $10,000 filing fee. One can hope the IRS will see reason and will reduce the fees for 2017. Most likely the IRS will not. Although the 11 reasons the IRS lists as warranting the waiver of the 60-day rule are certainly welcomed by taxpayers, there are certainly other reasons for which the IRS should grant relief

Edited on: Tuesday, November 08, 2016 14:19.57

Categories: Pension Alerts, Traditional IRAs

Monday, July 11, 2016

Planning Suggestion for an IRA Beneficiary Designation-Consider the Primary Beneficiary Might Want to Disclaim

An IRA accountholder should almost always designate a primary beneficiaryand also designate one or more contingent beneficiary(ies). In some older IRA files the IRA accountholder has not designated a contingent beneficiary. In such situation, almost all IRA plan agreement forms provide that the IRA funds will then be paid to the decedent's estate. Tax options are not as many or as beneficial when an estate is the inheriting IRA beneficiary.

Be nice to your IRA clients and remind them periodically they should review and update their beneficiary designations, if appropriate. Of course, your IRA accountholders should be seeking the guidance of their legal and tax advisers.

Situation. John and Mary are now intheir 80's. Mary has $115,000 in her IRA. John has his own IRA with a balance approximating $75,000. Each has designated the other as their IRA beneficiary, but they did not designate any contingent beneficiaries. They have two daughters and a son. Mary died on July 8, 2016.

John has come into the bank because he wants these funds to go to the three children rather than himself. He believes this is what Mary wanted. That is, he wants three inherited IRAs set up for the three children.

The IRA custodian must not accommodate him. It would be tax fraud. It cannot be done since Mary had not designated the children as her contingent beneficiaries. If she would have designated the three children as her contingent beneficiaries and then John would have executed a valid disclaimer, then the desired result of having these IRA funds be inherited by the three children could have been realized. But this was not done.

If John executes the disclaimer now, Mary's estate will inherit her IRA and would have to comply with the RMD' rules applying to an estate beneficiary. John most likely would be making the situation worse. He will be better-off if he elects to treat Mary's IRA as his own and then withdraws only the RMD each year. He will, of course, name his three chi-dren as his IRA beneficiaries.

In summary, be nice to your IRA clients and remind them periodically they should review and update their beneficiary designations. In order to retain the flexibility of a primary beneficiary disclaiming his or her interest, one or more contingent beneficiaries need to have been designated by the deceased IRA accountholder. If so, additional planning options are then available

Edited on: Tuesday, November 08, 2016 14:19.33

Categories: Pension Alerts, Traditional IRAs

Tuesday, June 07, 2016

More Wealthier Individuals Should Be Making Nondeductible Traditional IRA Contributions - They Just Need Some Help and You Can Provide It

Wealthier individuals should be rushing to their bank to make a non-deductible IRA contribution. This is certainly true if they are a 401(k) participant.

This author admits his bias, many individuals should be making non-deductible traditional IRA contributions and they don’t do so because they (and their advisors) many times don’t understand the benefits, including how the related tax rules apply.

Every person should contribute as much as possible to a Roth IRA. Why? There are very few times under US income tax laws where INCOME is not taxed. That is, no taxes are owed with respect to Roth IRA funds if the Roth owner has met a 5-year rule and is age 59½ or older or the Roth owner is a beneficiary who has inherited the Roth IRA and the 5-year rule has been met.

The federal tax laws have been expressly written to make it impossible for a person with a high income to make an annual Roth IRA contribution. Some people (i.e. many Democrats) don’t want “wealthier” individuals to gain the benefit of contributing funds to a Roth IRA and earning tax-free income. They want them to pay more income taxes. A person who had tax filing status of single was ineligible to make a 2015 Roth IRA contribution if his or her MAGI (modified adjusted gross income) was $132,000 or more. A person who had filing status of married filing jointly was ineligible to make a 2015 Roth IRA contribution if the couple’s MAGI (modified adjusted gross income) was $193,000 or more. A person who had filing status of married filing separately was ineligible to make a 2016 Roth IRA contribution if his or her MAGI (modified adjusted gross income was $10,000 or more.

For discussion and illustration purposes, we will assume that Jane Doe has the following situation. She is age 54. She is married. Her husband, Mark Doe, is a bank president. He is age 57. Their joint income is sufficiently high that neither one of them is eligible to make an annual Roth IRA contribution. Their joint income is sufficiently high that neither one of them is eligible to made a deductible traditional IRA annual contribution.

This article is going to discuss the question, “should these two each make a non-deductible traditional IRA contribution?” The primary concern is Jane’s situation, but we will also discuss Mark’s situation.

For the reasons discussed below, both should make a maximum non-deductible traditional IRA contribution until each is no longer eligible to make a traditional IRA contribution (i.e. the year a person attains age 70½).

On March 15, 2016, Jane contributed $6,500 to a traditional IRA she had established in 1984. She designated her contribution as being for 2015. The IRA balance at the time of contribution was $8,500. With the addition of her $6,500 contribution the IRA balance became $15,000. Since then the account has earned $40 of interest.

It is now assumed that Jane has no other IRA funds in any traditional, SEP or SIMPLE IRAs. The IRA taxation rules require in applying the taxation rules that all non-Roth IRA funds be aggregated. One cannot avoid the pro-rata taxation rule by setting up separate IRAs or having separate time deposits.

The couple’s tax preparer has recently informed Jane that her contribution is non-deductible as her husband participates in a 401(k) plan and their MAGI is sufficiently high that they are not permitted to claim any tax deduction for her $6,500 contribution. What tax options are available to her? What options are unavailable to her?

- She may not use the recharacterization rules to make her traditional IRA contribution a Roth IRA contribution as their 2015 MAGI is too high

- There is no IRS guidance allowing the IRA custodian to switch the year for which the IRA contribution was made from 2015 to 2016

- The IRS has issued rules allowing her to withdraw her 2015 IRA contribution with no adverse tax consequences as long as she does so by 10-15-16, no deduction is claimed on the 2015 tax return and the related income is withdrawn. If she withdraws her $6,500 contribution she is required to withdraw the related income and it is taxable for 2016 since the contribution was made in 2016. The related income is a pro-rata amount of the $40 determined as follows: 6500.15000 x $40 = $17.33. Since she is younger than age 59½ she does owe the 10% additional tax on this $17.33. The bank as the IRA custodian will prepare a 2016 Form 1099-R inserting the codes (81) in box 7, box 1 would show $6,517.33 and box 2a would show $17.33

- In 2016 she is eligible to make a Roth IRA conversion of any amount in the range of $.01 to $15,040. If she would convert $15,040 into her Roth IRA she/they would include in income on their 2016 tax return the amount of $8,540. She as many taxpayers does not want to include the $8,540 in her/their income and pay tax on it.

Jane as many taxpayers would like to convert only her non-deductible contribution of $6,500. This would allow her to pay no taxes since she would not be converting any of the $8,540.

The tax rules require use of the standard pro-rata taxation rule when an IRA has taxable funds and non-taxable funds. If she converts $6,500, a portion would be taxable and a portion would not be. The taxable portion is: $6,500 x $8,540/$15,040 ($3,690.82) and the non-taxable portion is $6,500 x $65,00/15,040 ($2809.18) . Jane made a nondeductible IRA contribution for 2015. She is required to file Form 8606 and attach to the couple’s Form 1040. If it was not filed with the original return, an amended tax return should be filed and the 2015 Form 8606 attached. She is not relieved of this duty because she withdraws the $6,500 or converts it. A $50 penalty applies to a person who fails to file Form 8606 unless she could show a reasonable cause why she did not file it. A person must pay a $100 penalty if a person overstates the amount of nondeductible contributions.

Note that Jane will also be required to file a 2016 Form 8606 regardless if she withdraws a portion or all of the $6,500.

Having to include in income the amount of $8540 and pay tax on this amount should not influence Jane or any other wealthy person to not make non-deductible contributions. But it does. Tax on $8540 should not be that material to a couple who are ineligible to make annual Roth IRA contributions.

From a practical standpoint, Jane could convert her traditional IRA over a 2-4 year time period to lessen the amount of income which would be taxed each year.

The best of all “planning” situations would be if Jane would either work for an employer that had a 401(k) plan written to accept rollovers from traditional IRAs or if she could work for the bank and become eligible under the bank’s 401(k) plan. Why? If Jane was a participant of a 401(k) plan, the tax rules have been so written that if she wants to make a rollover contribution, the amount rolled over “first” is the taxable portion. The prorate rule does not apply in this situation.

If Jane only rolls over $8,540, this means that the $6,500 remaining in the IRA are non-taxable. She may then convert such amount to a Roth IRA. This is her goal, this any person’s goal.

In summary, Jane wants to make as make non-deductible IRA contributions (currently $6,500 but his amount which change as it is indexed for inflation) as she can between ages 54-701/2 because she should convert all such funds into a Roth IRA.

What about her husband, Mark? He too wants to make the maximum amount of nondeductible IRA contributions from ages 57-70½ and at some point convert such contributions to a Roth IRA. The sooner the conversion can be completed the better as the earnings realized after the conversion will be tax-free if the qualified distribution rules are met.

Most likely Mark participates in a 40(k) plan which will allow him to move “taxable” IRA money into his 401(k) account. If not, he probably has the ability to rewrite the plan so he would have this right.

The 401(k) plan in which he participates may allow him to make Designated Roth deferrals and he exercises that right to the maximum. This would be $24,000 for 2016 ($18,000 + $6,000). Good for him. But why not contribute an additional $6,500 to his traditional IRA as a non-deductible contribution and convert it? Contributing $6500 for 12 years would result in an additional $78,000 in a Roth IRA.

In summary, Mark too should want to make as many non-deductible traditional IRA contributions as he is eligible for until he is no longer eligible to make traditional IRA contribution.

Edited on: Tuesday, November 08, 2016 14:19.19

Categories: Pension Alerts, Traditional IRAs

Warning – Determine if Your IRA Processor Has Prepared Some of Your Institution’s 5498 Forms Incorrectly

An IRA custodian called CWF with the following situation/question. Jane Doe has her own personal traditional IRA and she has an inherited traditional IRA arising from her mom. The IRA processor prepared just one combined 2015 Form 5498. Is this correct or permissible?

It is incorrect. Two 5498 forms must be prepared. It is understandable why a software engineer would think that it is better and simpler if just one form 5498 record is prepared rather than multiple forms. It is not simpler. The IRS rules do not permit aggregation of the data when there are multiple IRA plan agreements. The IRS has had the rule for a long time that contributions, distributions and fair market value statements are prepared and reported on a per plan agreement basis.

IRA tax data may be aggregated on a per IRA plan agreement basis, but it is not permissible to aggregate data from multiple IRA plan agreements. For example, Jane Doe age 53 has IRA Plan #1 and makes three $2,000 contributions for tax year 2015 on 3/10/15, 9/10/15 and 3/1/16 and she made a rollover contribution from a 401(k) plan to IRA Plan #1 of $12,000 on 6/10/15 and another rollover contribution from her 401(k) plan of $23,000 on 10/10/15. Box 1 will be completed with $6,000 and box 2 will be completed with $35,000.

As the discussion below illustrates, there is tax logic to the rule that there must be a separate IRA reporting form prepared on a per IRA plan agreement basis rather than allowing the reporting entity to aggregate the information and then furnish one form.

For example, Jane Doe has her own traditional IRA and she has has also inherited her mom’s traditional IRA. There must be two also separate 5498 forms prepared for her. For income taxation purposes she does not aggregate her IRA with the inherited IRA from her mother.

Preparation of a combined Form 5498 is a violation of IRS requirements. The IRS has the authority to assess a fine of $50 for each incorrect form and $50 for each missed form. Remember, the fines are doubled in the sense that one form goes to the IRS and one copy to the individual. Most likely the processor in its contract tries to have the IRA custodian be liable for this type of mistake. It’s CWF opinion that if the processor has written its software to not comply, it should be liable for any IRS fines.

What tax harm is being caused by such impermissible aggregation?

A person must do separate tax calculations for distributions from personal IRAs and inherited IRAs. This capability is lost if the data is aggregated.

If two 5498 forms both show a rollover contribution, most likely the IRS will determine that only one of them qualifies to be a rollover contribution because of the once per year rule and the other would be a taxable distribution. This audit capability is lost if there is just one combined Form 5498 prepared. The IRS prepares many statistical studies based on the info set forth on the 5498 forms. Many analytic capabilities are lost if there is not one Form 5498 prepared for each plan agreement.

Edited on: Tuesday, November 08, 2016 14:18.56

Categories: Governmental Reporting, Pension Alerts, Traditional IRAs

Thursday, June 02, 2016

CWF's Guidance on Transfers and Direct Rollovers

Direct rollovers from 401(k) plans into traditional IRAs average more than $75,000.

The tax rules applying to a transfer contribution are very different from those applying to rollover contribution (direct or indirect).

Procedures must exist to minimize IRA custodian errors. Errors arise because IRA personnel do not understand that the tax rules differ from transfers and direct rollovers. They are not the same and IRA staff sometimes fail to know this.

For example, a check for $65,000 is sent to First State Bank (FSB) fbo Jane Doe's traditional IRA. The personnel of First State Bank process the contribution as a transfer as they forget to ask the question, "what type of plan issued the check?". The problem is, the check was issued because Jane Doe had instructed her former employer's 401(k) plan to directly roll over her 401(k) funds to a traditional IRA. Since the check was processed as a transfer, FSB did not report this contribution on the Form 5498 as a rollover as it is required to do. No doubt the IRS will contact your customer who will contact you and the IRS will be interested in learning why FSB did not report this rollover on the Form 5498.

Solution. Determine that you and your IRA staff know what is needed to be known regarding transfers, direct rollovers and rollovers. We at CWF can assist. Call us at 800.346.3961 or visit our website for information on webinars, IRA Tests, IRA Procedure Manual and IRA Rollover Certification Forms.

If your IRA rollover form has a print or revision date prior to 2015, it is obsolete and should be discarded.

Edited on: Tuesday, November 08, 2016 14:18.32

Categories: Pension Alerts, Traditional IRAs

Wednesday, May 25, 2016

Inheriting HSA Beneficiary - Duty to Prepare Form 8889

If the HSA owner's surviving spouse is the designated beneficiary, the surviving spouse becomes the HSA owner. Consequently, he or she completes Form 8889 for transactions occurring after the HSA owner's death.

If the HSA owner has designated a non-spouse beneficiary and dies, the HSA ceases being an HSA. If the inheriting beneficiary is not the HSA owner's estate, the beneficiary completes Form 8889 as follows.

- Across the top of the form write, “Death of HSA Owner.

- At the top the beneficiary will insert his/her name and social security number. Part I (Contributions) is not to be completed. It is to be skipped as no additional HSA contributions may be made by a beneficiary

- On line 14a the HSA’s fair market value as of the date of death is inserted. The beneficiary includes this amount in his or her taxable income for the year during the HSA owner died. This is true even if the beneficiary withdraws the funds in a following year. The 20% penalty for non-medical use does not apply. Any earnings realized after the death of the HSA owner are included in the beneficiary's income for the withdrawal year. The HSA Custodian/trustee prepares the Form 1099-SA to report the distribution to the beneficiary for the year during which the withdrawal occurs

- The remainder of Part II (Distributions) is to be completed

- If the beneficiary pays within one year of the date of death medical expenses incurred by the HSA owner prior to his or her death, then such amount is to be listed on line 15. At times the beneficiary may need to file an amended tax return.

If the inheriting beneficiary is the HSA owner's estate, the final tax return and Form 8889 for the HSA owner as follows.

- Across the top of the form write, “Death of HSA Owner.

- Part I is to be completed, if applicable. That is, if the HSA owner made contributions prior to his death, they are reported

- On line 14a the HSA fair market value as of the date of death is inserted. This amount is included on the deceased HSA owner's final tax return for the year he or she died. This is true even if the personal representative withdraws the funds in a following year.

- The remainder of Part II (Distributions) is to be completed

- If the estate pays within one year of the date of death medical expenses incurred by the HSA owner prior to his or her death, then such amount is to be listed on line 15. At times the final tax return for the deceased HSA owner may need to file an amended tax return.

There are two times when a person is apparently required to file a paper tax return (versus an electronic filing) and file multiple 8889 forms.

The first situation is the person has his or her own personal HSA and then inherits an HSA. The person must prepare a Form 8889 for each HSA and a summary Form 8889. “Statement is to be written at the top of each of the non-summary 8889 forms. These statements are to be attached to the summary Form 8889. The IRS instructions use the term “controlling 8889”, we prefer “summary 8889.”

Edited on: Tuesday, November 08, 2016 14:18.19

Categories: Health Savings Accounts, Pension Alerts

Tuesday, May 24, 2016

CWF Discusses - Non-Deductible Traditional IRA Contributions by Bank Presidents and other High Income Individuals

More Wealthier Individuals Should Be Making Non-deductible Traditional IRA Contributions - They Just Need Some Help and You Can Provide It.

Wealthier individuals should be rushing to their IRA custodian/trustee to make a non-deductible IRA contribution. This is certainly true if they are a 401(k) participant.

Many individuals should be making non-deductible traditional IRA contributions and they don’t do so because they (and their advisors) many times don’t understand the benefits, including how the related tax rules apply. Every person should contribute as much as possible to a Roth IRA. Why? There are very few times under US income tax laws where Income is not taxed. That is, no taxes are owed with respect to Roth IRA funds if the Roth owner has met a 5-year rule and is age 59½ or older or the Roth owner is a beneficiary who has inherited the Roth IRA and the 5-year rule has been met.

The federal tax laws have been expressly written to make it impossible for a person with a high income to make an annual Roth IRA contribution. Some people (i.e. many Democrats) don’t want “wealthier” individuals to gain the benefit of contributing funds to a Roth IRA and earning tax free income. They want them to pay more income taxes. A person who had tax filing status of single was ineligible to make a 2015 Roth IRA contribution if his or her MAGI (modified adjusted gross income) was $132,000 or more. A person who had filing status of married filing jointly was ineligible to make a 2016 Roth IRA contribution if the couple’s MAGI was $193,000 or more. A person who had filing status of married filing separately was ineligible to make a 2016 Roth IRA contribution if his or her MAGI was $10,000 or more.

For discussion and illustration purposes, we will assume that Jane Doe has the following situation. She is age 54. She is married. Her husband, Mark Doe, is a bank president. He is age 57. Their joint income is sufficiently high that neither one of them is eligible to make an annual Roth IRA contribution. Their joint income is sufficiently high that neither one of them is eligible to made a deductible traditional IRA annual contribution.

This article is going to discuss the question, “should these two each make a non-deductible traditional IRA contribution?” For the reasons discussed below, both should make a maximum non-deductible traditional IRA contribution until each is no longer eligible to make a traditional IRA contribution (i.e. the year a person attains age 70½).

On March 15, 2016, Jane contributed $6,500 to a traditional IRA she had established in 1984. She designated her contribution as being for 2015. The IRA balance at the time of contribution was $8,500. With the addition of her $6,500 contribution the IRA balance became $15,000. Since then the account has earned $40 of interest. It is now assumed that Jane has no other IRA funds in any traditional, SEP or SIMPLE IRAs. The IRA taxation rules require in applying the taxation rules that all non-Roth IRA funds be aggregated. One cannot avoid the pro-rata taxation rule by setting up separate IRAs or having separate time deposits.

The couple’s tax preparer has recently informed Jane that her contribution is non-deductible as her husband participates in a 401(k) plan and their MAGI is sufficiently high that they are not permitted to claim any tax deduction for her $6,500 contribution. What tax options are available to her? What options are unavailable to her?

She may not use the recharacterization rules to make her traditional IRA contribution a Roth IRA contribution as their 2015 MAGI is too high.

There is no IRS guidance allowing the IRA custodian to switch the year for which the IRA contribution was made from 2015 to 2016.

The IRS has issued rules allowing her to withdraw her 2015 IRA contribution with no adverse tax consequences as long as she does so by 10-15-16, no deduction is claimed on the 2015 tax return and the related income is withdrawn. If she withdraws her $6,500 contribution she is required to withdraw the related income and it is taxable for 2016 since the contribution was made in 2016. The related income is a pro-rata amount of the $40 determined as follows: 6500.15000 x $40 = $17.33. Since she is younger than age 59½ she does owe the 10% additional tax on this $17.33. The bank as the IRA custodian will prepare a 2016 Form 1099-R inserting the codes (81) in box 7, box 1 would show $6,517.33 and box 2a would show $17.33.

In 2016 she is eligible to make a Roth IRA conversion of any amount in the range of $.01 to $15,040. If she would convert $15,040 into her Roth IRA she/they would include in income on their 2016 tax return the amount of $8,540. She as many taxpayers does not want to include the $8,540 in her/their income and pay tax on it. Jane as many taxpayers would like to convert only her non-deductible contribution of $6,500. This would allow her to pay no taxes since she would not be converting any of the $8,540. The tax rules require use of the standard pro-rata taxation rule when an IRA has taxable funds and nontaxable funds. If she converts $6,500, a portion would be taxable and a portion would not be. The taxable portion is: $6,500 x $8,540/$15,040 ($3,690.82) and the non-taxable portion is $6,500 x $65,00/15,040 ($2,809.18) . Jane made a non-deductible IRA contribution for 2015. She is required to file Form 8606 and attach to the couple’s Form 1040. If it was not filed with the original return, an amended tax return should be filed and the 2015 Form 8606 attached. She is not relieved of this duty because she withdraws the $6,500 or converts it. A $50 penalty applies to a person who fails to file Form 8606 unless she could show a reasonable cause why she did not file it. A person must pay a $100 penalty if a person overstates the amount of non-deductible contributions. Note that Jane will also be required to file a 2016 Form 8606 regardless if she withdraws a portion or all of the $6,500.

Having to include in income the amount of $8,540 and pay tax on this amount should not influence Jane or any other wealthy person to not make non-deductible contributions. But it does. Tax on $8,540 should not be that material to a couple who are ineligible to make annual Roth IRA contributions. From a practical standpoint, Jane could convert her traditional IRA over a 2-4 year time period to lessen the amount of income which would be taxed each year.

The best of all “planning” situations would be if Jane would either work for an employer that had a 401(k) plan written to accept rollovers from traditional IRAs or if she could work for the bank and become eligible under the bank’s 401(k) plan. Why? If Jane was a participant of a 401(k) plan, the tax rules have been so written that if she would rollover a portion of the $15,040, the amount rolled over “first” is the taxable portion. The prorate rule does not apply in this situation. If Jane only rolls over $8,540, this means that the $6,500 remaining in the IRA are non-taxable. She may then convert such amount to a Roth IRA. This is her goal, this any person’s goal.

Jane wants to make as many non-deductible IRA contributions (currently $6,500 but his amount which change as it is indexed for inflation) as she can between ages 54-70½ because she should convert all such funds into a Roth IRA. What about her husband, Mark? He too wants to make the maximum amount of non-deductible IRA contributions from ages 57-70½ and at some point convert such contributions to a Roth IRA. The sooner the conversion can be completed the better as the earnings realized after the conversion will be tax free if the qualified distribution rules are met.

Most likely Mark participates in a 40(k) plan which will allow him to move ‘taxable IRA money into his 401(k) account. If not, he probably has the ability to rewrite the plan so he would have this right. The 401(k) plan in which he participates may allow him to make Designated Roth deferrals and he exercises that right to the maximum. This would be $24,000 for 2016 ($18,000 + $6,000). Good for him. But why not contribute an additional $6,500 to his traditional IRA and convert it? Contributing $6500 for 13 or 14 years would result in an additional $84,500 or $91,000 in a Roth IRA. Those individuals attaining age 70 between July and December 31st are eligible to make a contribution for their "70" year whereas those who attain age 70 and 70½ are ineligible.

Be aware that under existing laws Roth IRA funds are ineligible to be rolled over into a 401(k) plan. This is true even for 401(k) plans having Designated Roth features.

Mark too should want to make as many non-deductible traditional IRA contributions as he is eligible for until his 70½ year.

In summary, a bank president and his/her spouse want to make as many non-deductible traditional IRA contributions as possible prior to his/her 70½ year. With some pre-planning, it will be possible to convert these to be Roth IRA conversion contributions.

Edited on: Tuesday, November 08, 2016 14:17.46

Categories: Pension Alerts, Traditional IRAs

Wednesday, August 19, 2015

SIMPLE-IRA Summary Description — IRA Custodian Must Furnish by October 2015 for 2016

What are a financial institution’s duties if it is the custodian or trustee of SIMPLE IRA funds? After a SIMPLE IRA has been established at an institution, it is the institution’s duty to provide a Summary Description each year within a reasonable period of time before the employees’ 60-day election period. CWF believes that providing the Summary Description 30 days prior to the election period would be considered “reasonable.” The actual IRS wording is that the Summary Description must be provided “early enough so that the employer can meet its notice obligation.” You will want to furnish the Summary Description to the employer in September or the first week of October. The employer is required to furnish the summary description before the employees’ 60-day election period.

IRS Notice 98-4 provides the rules and procedures for SIMPLEs.

The Summary Description to be furnished by the SIMPLE IRA custodian/trustee to the sponsoring employer depends upon what form the employer used to establish the SIMPLE IRA plan.

The employer may complete either Form 5305-SIMPLE ( where all employees’ SIMPLE IRAs are established at the same employer-designated financial institution ) or Form 5304-SIMPLE ( where the employer allows the employees to establish the SIMPLE IRA at the financial institution of their choice ).

There will be one Summary Description if the employer has used the 5305-SIMPLE form. There will be another Summary Description if the employer has used the 5304-SIMPLE form. If you are a user of CWF forms, these forms will be Form 918-A and 918- B.

The general rule is that the SIMPLE IRA custodian/trustee is required to furnish the summary description to the employer. This Summary Description will only be partially completed. The employer will be required to complete it and then furnish it to his employees. The employer needs to indicate for the upcoming 2016 year the rate of its matching contribution or that it will be making the non-elective contribution equal to 2% of compensation.

In the situation where the employer has completed the Form 5304-SIMPLE, the IRS understands that many times the SIMPLE IRA custodian/trustee will have a minimal relationship with the employer. It may well be that only one employee of the employer establishes a SIMPLE IRA with a financial institution. In this situation, the IRS allows the financial institution to comply with the Summary Description rules by using an alternative method. To comply with the alternative method, the SIMPLE IRA custodian/trustee is to furnish the individual SIMPLE IRA accountholder the following:

- A current 5304-SIMPLE — this could be filled out by the employer, or it could be the blank form

- Instructions for the 5304-SIMPL

- Information for completing Article VI ( Procedures for withdrawal ) (You will need to provide a memo explaining these procedures. )

- The financial institution’s name and address. Obviously, if an institution provides the employee with a blank form, he/she will need to have the employer complete it, and, the employee may well need to remind the employer that it needs to provide t he form to all eligible employees.

CWF has created a form that covers the “alternative” approach of the Summary Description being provided directly to an employee.

The penalty for not furnishing the Summary Description is $50 per day.

Special Rule for a “transfer” SIMPLE IRA.

There is also what is termed a “transfer” SIMPLE IRA. If your institution has accepted a transfer SIMPLE IRA, and there have been no current employer contributions, then there is no duty to furnish the Summary Description. If there is the expectation that future contributions will be made to this transfer SIMPLE IRA, then the institution will have the duty to furnish the Summary Description.

Reminder of Additional Reporting Requirements

The custodian/trustee must provide each SIMPLE IRA account holder with a statement by January 31, 2016, showing the account balance as of December 31, 2015 , (this contribution and distribution is the same as for the traditional IRA ), and include the activity in the account during the calendar year ( this is not required for a traditional IRA ). There is a $50 per day fine for failure to furnish this statement ( with a traditional IRA, it would be a flat $50 fee )

Wednesday, July 15, 2015

Roth IRA Conversions, Is it Worthwhile For a Person to Change State of Residence Before Converting ?

For most individuals it will not be worth the effort or the inconvenience to change their state of residence prior to doing a Roth IRA conversion contribution. For others, not having to pay state income tax on the conversion will make it worthwhile.

When one converts the funds within his traditional IRA to a Roth IRA, he will include the taxable amount in his income for federal income tax purposes.

What about state income tax? Individuals residing in states with incomes taxes will also need to pay state income tax on the amount converted if they reside in a state that assesses an income tax. For some, this may be substantial as the highest tax rate is the following in: ( California-13.3%, Hawaii- 11.01%, Oregon-9.9%, Minnesota- 9.85%, Iowa - 8.98%, New Jersey- 8.97%, New York-8.82%, etc.).

For example: An individual residing in California, New York, Michigan, Minnesota, Iowa or any other state with an state income tax may wish to move to a state with no income tax ( Texas, Florida, Tennessee, Nevada, Wyoming, Washington, and South Dakota. ) for the period required under the various state laws to avoid paying the state income tax with respect to his Roth IRA conversion.

For most individuals it will not be worth the effort or the inconvenience, but for others the tax savings will make it worthwhile to move to a state without a income tax for a certain time period so that the individual may convert his or her Roth IRA and avoid paying state income tax. Under current laws, a person could return to his “home” state later after doing the conversion while residing in another state. Time will tell if these states will enact laws giving them the right to try to tax such funds even though the conversion had occurred when a person was a non-resident.

Thursday, April 30, 2015

DOL Re-Proposes Rule on Definition of a Fiduciary for IRAs and Pension Plans

On April 20, 2015 the DOL finally issued its long awaited revised definition of who is a fiduciary. The DOL in 1975 issued a regulation defining a fiduciary. The current DOL does not like this definition and wants to change it.

The DOL’s proposal is very complicated and time will tell to what extent this proposal will be implemented. There is going to be substantial negative response to this proposal. One would hope Congress will take an active role in this matter because the DOL is essentially making new law without instruction from Congress to do so.

In October of 2010 the DOL proposed a new definition of who is a fiduciary for pension and IRA purposes. In September of 2011 after receiving substantial negative comments from powerful politicians from both parties the DOL stated it would be withdrawing the 2010 proposal.

The 2015 proposal would treat persons who provide investment advice or various recommendations to an IRA, the IRA owner, pension plan, plan fiduciary, the plan participant or a beneficiary as a fiduciary. The proposal contains certain exceptions when a person would not be considered to be a fiduciary,. but these exception rules are murky at best.

One of the primary goals of the DOL is to make any one serving an IRA or pension plan a fiduciary and then require such person to act in the best interest of the IRA owner or the pension plan participants. In theory this may seem very desirable, but it is unworkable in the real world. The DOL is well aware of the large amount of wealth being directly rolled over into IRAs from 401(k) plans and other retirement plans ($2 trillion over the next 5 years). The DOL believes that individuals who are non-fiduciaries may give imprudent and disloyal advice and then direct IRA owners to invest their IRA funds in investments based on their own interests rather than the best interest of the IRA owners (i.e. their clients). The DOL also believes most individuals are incapable of managing their own IRAs. The powers that be within the DOL do not really like that fact that most 401(k) plans are written to allow for participants to invest their own account balances. The DOL believes that professional money managers would do a better job.

In October of 2010, the EBSA had published a proposed rule revising a 1975 regulation defining when a person is a “fiduciary” with respect to an IRA or pension plan by reason of giving investment advice for a fee. The 1975 regulation provided for a five-part test to determine if a person was a fiduciary. Under this rule, a person is a fiduciary only if he or she:

- makes recommendations on investing in, purchasing or selling securities or other property, or gives advice as to their value

- on a regular basis;

- pursuant to a mutual understanding that the advice;

- will serve as a primary basis for investment decisions; and

- will be individualized to the particular needs of the IRA or plan.

A person who did not meet all five conditions was and is not a fiduciary. The current EBSA believes there are situations where a person should be a fiduciary even though they are not one under existing law. One example, an investment representative selling an investment product to an IRA owner making a rollover contribution is not a fiduciary since he or she most likely is not performing services on a “regular basis”. So, the new rule has been proposed with the goal to make many more individuals fiduciaries.

The DOL’s proposal, if adopted, will radically change the definition of whom would be a fiduciary for IRA and pension purposes. We will will keep you informed. We expect Congress will furnish a response to the DOL’s proposal within the next 2-6 weeks. We would suggest a bank serving as an IRA custodian/ trustee will wish to inform its congressional representatives that this proposed regulation is too complicated and the DOL should be informed it should not be adopted and implemented.

Edited on: Wednesday, May 06, 2015 11:23.19

Categories: Pension Alerts

Wednesday, November 19, 2014

Additional IRS Guidance on the Once Per year Rollover Rule and the IRS Can't Be Serious About IRA Transfers

The author of this article is an old tennis nut. John McEnroe’s 1981 tennis exclamation of the 1980’s that “you can not be serious” fits many situations.

The IRS has recently issued additional tax guidance on the once per year rollover rule which goes into effect on January 1, 2015. IRS NewsWire 2014-107 and Announcement 2014-32. This is the third or fourth time the IRS has issued guidance since the tax court’s decision (Bobrow) in January of 2014. The court ruled that a person is allowed to make only one distribution/rollover in a one-year period regardless of how many different IRA plan agreements a person has.

The initial IRS guidance maybe was not as comprehensive or clear as it should have been. One would hope the IRS wants to provide comprehensive guidance on tax subjects so that everyone involved can perform their tax duties.

The most recent guidance makes clear that a person who rolls funds from one Roth IRA to another Roth IRA is ineligible to rollover funds from his or her traditional IRA to another traditional IRA during the one-year period commencing on the withdrawal of the Roth IRA funds. And that any subsequent distributions by this person within the one-year time period from any or his or her IRAs will be ineligible to be rolled over tax free.

The IRS has still not yet commented (furnished guidance) whether an IRA trustee must or should inform existing IRA owners of this change in the once per year rollover year. An existing IRA regulation does require an amended disclosure statement be furnished, but the IRS has not explained why this regulation does not apply if they believe that such an amendment is not required.

The IRS portrays itself as being taxpayer friendly. If the IRS was so friendly, the IRS did not need to agree so quickly to follow the tax court decision. One tax court decision need not be the final decision. The IRS could have appealed the tax court’s decision or asked Congress to change the law to expressly authorize the continuance of the old rule allowing rollovers on a per plan agreement basis. One would think this would be a bipartisan topic.

The IRS is in the business of maximizing the tax revenues of the federal government. Limiting the number of rollovers a person is eligible to make will in some cases lead to more individuals having to pay incomes taxes they otherwise would not have had to pay or at least not as soon. Unlike with pension plans, the law and the IRS has not adopted any procedures allowing IRA mistakes to be corrected. The IRS likes IRA mistakes in the sense that additional taxes in many cases will be owed and paid. However, this conflicts with the fact that the more a person pays in taxes on account of his or her IRA mistakes means less funds for retirement. In some cases, the IRS doesn't’t care and the IRS wants to maximize its collection of tax dollars.

The IRS states in its guidance that it encourages IRA trustees to offer to its IRA owners a transfer distribution of funds rather than a distribution followed by a rollover contribution. A transfer is not subject to the once per year rule as there is no actual taxable distribution. Allowing transfers will lessen the impact of the new once per year rollover rule. The IRS understands that IRA trustees are not required by the tax laws to participate in a transfer. The two involved IRA plan agreements must authorize the transfer.

The IRS states, “IRA trustees can accomplish a trustee to trustee transfer by transferring amounts directly from one IRA to another or by providing the IRA owner with a check made payable to the receiving IRA trustee.”

The IRS does not give a comprehensive discussion (or any examples) on what it means by making “the check payable to the receiving IRA trustee.” Admittedly, the IRS is trying to give a keep it as simple as possible explanation. But sometimes an approach can be too simple and tax problems are sure to arise.

With the many law changes impacting transfers, some transfers are reportable and some are not. Reportable means one of the IRA trustees must report the transfer distribution on a Form 1099-R and the one of the trustees must report the contribution on the Form 5498 either as rollover, conversion, recharacterization or a qualified HSA funding distribution. In this rollover guidance the IRS offers no guidance as to how reportable transfers are to be handled by the two IRA trustees or by the IRA trustee and the HSA trustee.

Furnishing an IRA trustee or an HSA trustee with only a check will not assure the proper tax administration. In order to assure the correct administration of the transferred IRA funds, the receiving IRA trustee will in some cases need to be furnished certain historical information from the transmitting institution. The IRS does not discuss this topic in any detail. It appears the IRS may be allowing the individual to furnish this information and not require that the remitting institution furnish it. This is shortsighted and it is why this situation is a “you can’t be serious” situation. The IRS should furnish additional guidance.

The IRS seems to authorize the check may be made payable to “ABC Bank” and does not require additional information such as “ABC Bank as Roth IRA trustee fbo Jane Doe” or “ABC Bank as the inherited traditional IRA trustee fbo John Smith abo Mary Smith’s IRA” or “ABC Bank as the HSA trustee fbo of Maria Bell.”

Current IRS procedures provide that an IRA trustee is not to report a “non reportable” transfer on either the Form 1099-R or the Form 5498. CWF has received quite a few consulting calls indicating that some brokerage firms (some large ones) prepare the Form 1099-R for all transfers. This makes their life easier, but complicates the life of every departing IRA owner since he/she must explain on his/her tax return why the amount on the Form 1099-R is not taxable. The IRS apparently does not fine an IRA trustee which prepares a Form 1099-R not required to be prepared. The IRS needs to start imposing fines on such IRA trustees.

As a reminder there are certain distributions which are ignored for purposes of applying the once per year rule. Making a Roth IRA conversion contribution is not counted as a distribution/rollover. Making an HSA Funding distribution is not counted as a distribution/rollover. However, moving funds from an IRA to a 401(k) does count as a distribution/rollover.

Set forth are various examples illustrating why furnishing just a check will not allow for the proper tax administration. Hopefully, the IRS will again furnish additional guidance.

- Jane Doe instructs First Bank that she wishes to transfer $30,000 of her traditional IRA funds to Second Bank. She does not make clear into what type of account the $30,000 is to be reinvested. The check is made payable to Second Bank. No additional information is provided. Jane could instruct Second Bank that she wants the funds to go into a Roth IRA. She should include the $30,000 in her income. However, if both banks treat this transaction as a non-reportable transfer, the IRS will have no way short of a full audit to determine if Jane reports the transaction properly on her federal income tax return. She might escape including the $30,000 in her income. Presumably, the two IRA trustees could be fined for not preparing the Form 1099-R and the Form 5498 as is required when there is a Roth IRA conversion. Funds moving from a traditional IRA to a Roth IRA via transfer or rollover is a reportable transaction.

- John Hall instructs First Bank that he wishes to transfer $7,550 of his traditional IRA funds to Second Bank. He does not make clear into what type of account the $7,550 is to be reinvested. The check is made payable to Second Bank. No additional information is provided. John could instruct Second Bank that he wants the funds to go into his HSA. He would exclude the $7,550 from his income. However, if both banks treat this transaction as a non-reportable transfer, there will be noncompliance with the IRS reporting rules applying to an HSA Funding Distribution/Contribution

- Mary Long instructs First Bank that she wishes to transfer $45,000 of her inherited traditional IRA funds to Second Bank. Her mom had designated Mary as the beneficiary of her IRA. Mary does not make clear into what type of account the $45,000 is to be reinvested. The check is made payable to Second Bank. No additional information is provided. Mary could instruct Second Bank that she wants the funds to go into her own personal traditional IRA. The mistake could be intentional or unintentional. This means she no longer would have to comply with the required distributions rules. She would not be required to take an RMD until she would attain age 70½. If both banks treat this transaction as a non-reportable transfer, the IRS will have no way short of a full audit to determine that Jane made a non qualifying transfer.

- One last example. Jane withdrew $30,000 from IRA#1 on June 10, 2014 and she rolled it into IRA #4. She will be eligible to take a distribution from IRA #4 and roll it over only if she does so on or after June 10, 2015,and she has taken no other distribution from any of her other IRAs on or after January 1, 2015 which she rolled over. In conclusion, although the IRS states in recent guidance that all that is needed to transfer IRA funds is to issue a check to the other IRA trustee, CWF suggests that IRA transfer forms, IRA conversion forms and the form for an individual to certify the making a qualified HSA funding distribution still be used. The goal is to limit the mistakes made by individuals and IRA trustees.

Edited on: Tuesday, December 23, 2014 14:56.17

Categories: Pension Alerts

Friday, October 31, 2014

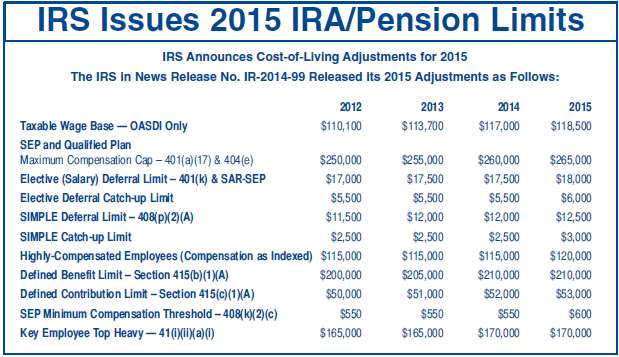

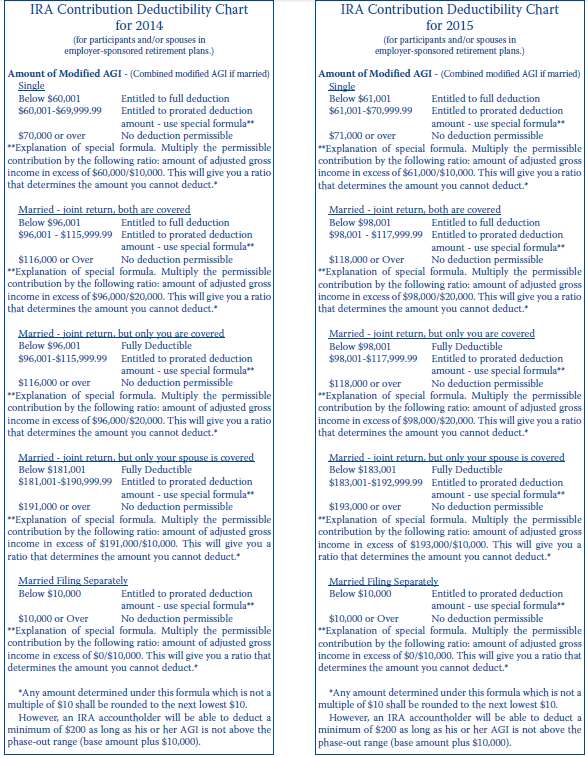

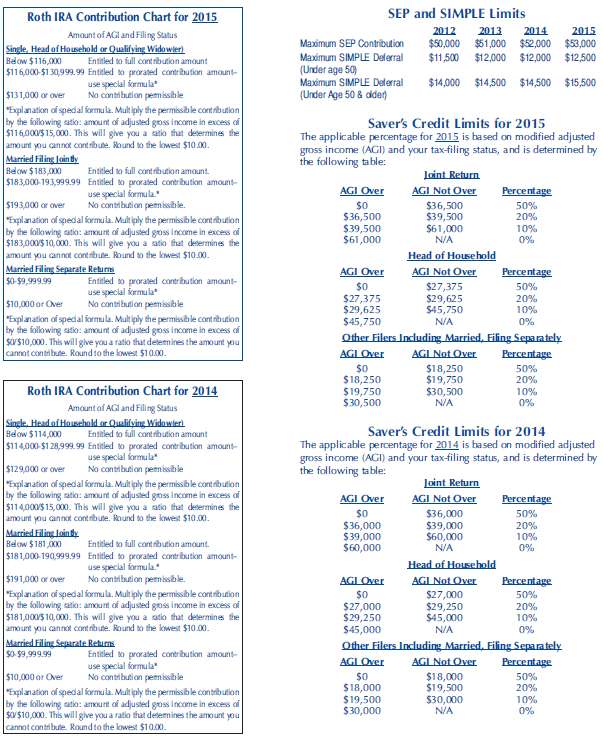

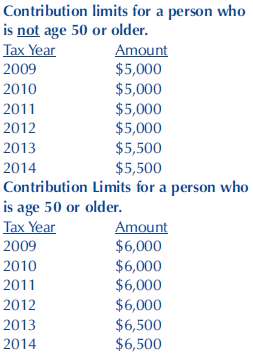

IRA Contribution Limits for 2015 – Unchanged at $5,500 and $6,500; 401(k) Limits Increase

Inflation was approximately 1.7% for the fiscal quarter ending September 30, 2014, so many of the IRA and pension limits as adjusted by the cost of living factor have not changed or the changes have been quite small.

The maximum IRA contribution limits for 2015 for traditional and Roth IRAs did not change – $5,500/$6,500.

The 2015 maximum contribution limit for SEP-IRAs is increased to $53,000 (or, 25% of compensation, if lesser) up from $52,000. The minimum SEP contribution limit used to determine if an employer must make a contribution for a part-time employee increases to $600 from $550.

The 2015 maximum contribution limits for SIMPLE-IRAs is increased to $12,500 if the individual is under age 50 and $15,500 if age 50 or older

The 2015 maximum elective deferral limit for 401(k) participants increases to $18,000 for participants under age 50 and to $24,000 for participants age 50 and older.

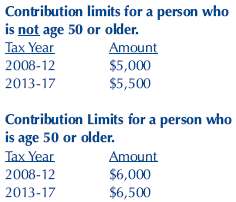

Contribution limits for a person Contributions

limits for a person

who is not age

50 or older who is age 50 or older

| Tax Year | Amount | Tax Year | Amount |

| 2008-12 | $5,000 | 2008-12 | $6,000 |

| 2013 | $5,500 | 2013 | $6,500 |

| 2014 | $5,500 | 2014 | $6,500 |

| 2015 | $5,500 | 2015 | $6,500 |

Edited on: Wednesday, November 19, 2014 12:31.25

Categories: Pension Alerts

Monday, July 21, 2014

Charging a Fee For a Direct Rollover of IRA Funds to a 401(k) Plan

A financial institution should consider instituting a fee if it agrees to directly rollover a customer’s IRA funds to his or her account within an employer’s 401(k) or 403(b) as discussed in the following email situation/question. It is only logical and right that a financial institution receive a reasonable fee for helping a customer when it agrees to issue a check directly to the 401(k) plan. You are helping your customer and also the 401(k) plan.

Technically, a direct rollover cannot occur between an IRA and a 401(k) plan as the law defines a direct rollover as only being between an employer sponsored plan and an IRA. But the IRS has adopted the rule that the reporting rules applying to a direct rollover from a 401(k) plan to an IRA are also to be used if the funds move from an IRA to a 401(k) plan.

The email question/situation:

Question regarding an IRA rollover from our bank to the customer’s 403b retirement plan. Assume the best is to issue a check directly to the customer and code the 1099-R as a G code? The customer will have to sign an IRA distribution form?

Please let me know if this is correct?, I have not had a request like this before, it is usually the reverse from a retirement plan into an IRA at the bank. Thanks so much for your help!

CWF’s answer/response:

The easiest approach for the bank is to issue the check to her and you would use code 1 if she is under age 59½ and 7 if she is over age 59½. You treat it as a normal distribution. Then she makes a rollover contribution to the plan.

The tax code does not require an IRA custodian to issue the check to the plan. However, many plans require the check to come from the IRA issued to the plan since this simplifies the plan administrator’s administrative concerns regarding accepting a rollover contribution.

If your institution decides to be nice and accommodate your customer, you will issue the check to ABC 401(k) Plan fbo Jane Doe. Use CWF’s Form 69 or a similar form as prepared by the plan administrator. And then you would use the reason code G in box 7 of the Form 1099-R. When G is used box 2, taxable amount, is to be completed with 0.00 as you know the amount the is non-taxable as you sent the funds directly to the plan. As you indicated it is the reverse of a direct rollover coming from a pension plan to an IRA.

An IRA custodian may have a fee for this special service as long as it has been disclosed. Like with transfer fees, we expect many customers would be willing to pay a fee for this special service.

No Bankruptcy Exemption For Funds Within an Inherited Individual Retirement Account

Those who work in the legal profession like to think the law is primarily logical and efficient. After all we are a nation of laws rather than individuals. We tend to forget that laws are enacted by politicians with input from their constituents. Many times there are self-serving motives. And sometimes judges do not like the laws which they must interpret and enforce or at least they see flaws needing to be corrected. Rather than have the legislature correct such flaws, sometimes courts choose to correct such flaws by a court ruling.

In 2005, the federal bankruptcy laws were changed. One major change dealt with credit card debt. It is now much harder to eliminate credit card debt by a bankruptcy filing. A second major change dealt with increasing the amount of funds in retirement plans and IRAs that a person could exempt from his or her bankruptcy estate. In general, the limit for IRAs is now $1,000,000 and the amount for funds in an employer sponsored pension plan is unlimited.

The public policy of the bankruptcy laws is that a person should be able to provide for himself or herself during their retirement years. However, the granting of such a large exemption for IRAs and pension plans means that many times creditors are left unpaid when an individual files for bankruptcy. Some people, including many judges, would consider such a large exemption amount to be contrary to the legal framework for bankruptcy. Yes, a person should be able to have a fresh start after incurring financial difficulties, but creditors are still entitled to be paid a reasonable and fair amount and that an individual should not have a “free pass” to an unfettered new and improved financial health.

The U.S. Supreme Court recently decided the case, Clark v. Rameker. Ms. Clark had inherited an IRA from her mother with an original balance of approximately $450,000 in 2001. The amount in her inherited IRA was approximately $300,000 when she filed for bankruptcy in October of 2010. Rameker is the bankruptcy trustee and has argued that Ms. Clark is not entitled to exempt the $300,000 from her bankruptcy estate. The bankruptcy court adopted the trustee’s position that Ms. Clark was not entitled to the exemption. Ms. Clark then appealed to the District Court. The District Court reversed the decision by ruling that Ms. Clark was entitled to exempt the amount in her inherited IRA. The trustee then appealed to the 7th Circuit Court of Appeals that which reversed the District Court. Since there had been split decisions in the circuit courts, the Supreme Court agreed to rule on the case to settle the issue.

The U.S. Supreme Court affirms the 7th Circuit position of no exemption for inherited IRA funds.

The legal analysis and rationale. The U.S. Supreme Court ruled, by a unanimous vote, that “The text and purpose of the Bankruptcy Code makes clear that funds held in inherited IRAs are not retirement funds within the meaning of section 522(b)(3)(C) is bankruptcy exemption.” Justice Sotomayer wrote the court’s opinion.

As discussed below, the U.S. Supreme Court had to strain the law to reach the result that allowed the bankruptcy trustee to win and Ms. Clark to lose.

How does Bankruptcy Code section 522(b)(3)(C) read ?

Bankruptcy code section 522(b)(3)(C) provides an exemption for “(C) retirement funds to the extent that those funds are in a fund or account that is exempt from taxation under section 401, 403, 408, 408A, 414, 457, or 501(a) of the Internal Revenue Code of 1986.” Code section 401 defines the laws for a qualified plan. Code section 403 defines the laws for tax sheltered annuities. Code section 408 defines the laws for traditional IRA and IRA annuities. Code section 408A defines the laws for Roth IRAs and Roth IRA annuities.No Bankruptcy Exemption For Funds Within an Inherited Individual Retirement Account

Note that there is no special tax code section for inherited IRAs. An inherited IRA is not a special type of IRA as the court tries to define it. An inherited traditional IRA is simply one that comes into existence after the IRA accountholder dies.

Also note that there is no express indication that the retirement funds must be the retirement funds of the bankruptcy debtor. This is what one expects when one has funds in a 401(k) plan or an IRA. These funds are within a legal and tax entity independent of the individual’s will or estate. There is a 401(k) plan agreement or an IRA plan agreement which requires the individual to designate one or more primary beneficiaries. Such plan indicates that the beneficiary acquires his or her share upon the death of the participant or IRA accountholder.

Notwithstanding that the account is called an inherited individual RETIREMENT account, the U.S. Supreme Court on June 2, 2014, ruled that funds within an inherited IRA are not retirement funds within the meaning of Bankruptcy Code section 522(b)(3)(C).

Federal bankruptcy laws allow an individual to exempt certain property from his or her bankruptcy estate. This is property he or she is allowed to keep after the bankruptcy and that cannot be claimed by the bankruptcy trustee. The approach of the bankruptcy laws is to give a person the ability to have a fresh start after incurring financial difficulties. Of course, there should be and there are limits as to the ability of a person not to pay his or her debts.

The attorney for the bankruptcy debtor argued that Bankruptcy code section 522(b)(3)(C) was clear – funds within any traditional IRA, including an inherited traditional IRA, as established under Code section 408 were entitled to the exemption. The District Court in this case, the Fifth Circuit in a different case and the Eighth Circuit in a different case had the same understanding. The rationale of the District Court was that the exemption covers any account containing funds originally accumulated for retirement purposes. This is consistent with the legal operation of a traditional IRA. It is a special tax-preferred revocable trust. It has two express purposes. Contributions and the investments will be used for the retirement of the IRA accountholder and then after his or her death will be used to benefit the designated beneficiary over a time period which may be as long as the life expectancy of the beneficiary.

The U.S. Supreme Court reached a different conclusion. In order to be entitled to claim the exemption of Bankruptcy Code section 522(b)(3)(C) , the court ruled that an individual has to meet two requirements, not just one requirement. First the funds must be retirement funds. Second, such funds must have been in a fund or account that is exempt from taxation under section 401, 403, 408, 408A, 414, 457, or 501(a) of the Internal Revenue Code of 1986.”

The U.S. Supreme Court wrote that the two words “retirement funds” as set forth in Bankruptcy Code section 522(b)(3)(C) mean more than just funds in the enumerated tax code sections. A cardinal rule of statutory construction is, “a statute should be construed so that effect is given to all its provisions, so that no part will be in operative or superfluous. The first six words, “retirement funds to the extent that” in order not to be superfluous must have a meaning or purpose independent of the enumerated sections.

The court then found that since there was no definition of “retirement funds” within the Bankruptcy Code that it must define the term and it did so. It defined retirement funds as sums of money set aside for the day an individual stops working.

The court then reasoned that there are three principal reasons why inherited IRA funds are not retirement funds. First, the beneficiary is unable to make any additional contributions. Second,No Bankruptcy Exemption For Funds Within an Inherited Individual Retirement Account the required distribution rules apply to an inherited IRA and distributions must be taken long before retirement age. Third, the 10% penalty tax does not apply to a beneficiary and so the beneficiary is able to take a distribution at any time and use the funds for current consumption. It is this later reason which seems to have influenced the court’s decision the most. The court stated its dislike for the possibility that a person who has an inherited IRA could file for bankruptcy, claim the exemption for retirement funds and then after the bankruptcy has been granted eliminating his or her debts immediately withdraw funds from the inherited IRA for personal consumption reasons. In essence the debtor would have a free pass which is not the intent of the Bankruptcy laws. The court was unwilling to give this free pass.

Additional Litigation

There will be additional litigation by bankruptcy trustees as a result of his case. The U.S. Supreme Court has made clear it is receptive to consider cases involving whether or not - the exemption of Code section 522(b)(3)(C) is available to a bankruptcy filing.

This case settles the issue with respect to an inherited traditional IRA.

The case of In Rousey v. Jacoway, settled that a traditional IRA was a retirement account within the meaning of Bankruptcy code section 522(b) (3) (C) and was entitled to be exempted from the individual’s bankruptcy estate.

When one reads this case, one certainly has the idea that an inherited Roth IRA would also be found to not be retirement funds for bankruptcy Code section 522(b)(3)(C) purposes.

What about standard Roth IRA funds? Although we expect that the rules of Rousey would apply to a Roth IRA and the exemption would apply, this issue has not been firmly settled. One can expect that a bankruptcy trustee will make the argument that Roth IRA funds are not retirement funds since the Roth IRA accountholder never has to take a distribution while alive.

What about inherited 401(k) funds still within the 401(k) plan? One can expect a bankruptcy trustee to argue that inherited 401(k) funds also are not retirement funds within the meaning of Bankruptcy Code section 522(b)(3)(C). ERISA protects such funds from creditors, including a bankruptcy trustee, as long as such funds are within the 401(k) or other pension plan. Many 401(k) plans have been written to require an inheriting beneficiary to withdraw or direct rollover his or her inherited funds within a short time period.