« Faulty IRA Information – Roth IRA Article From Certain Investment Firm and the Two Roth IRA 5-Year Rule(s) | Main | Excess HSA Contributions - The HSA Custodian Must Not Shirk its Responsibilities »

Friday, January 24, 2014

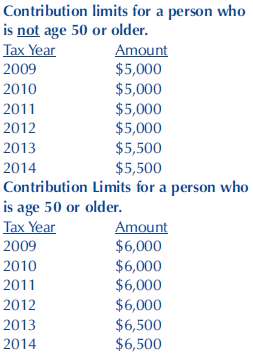

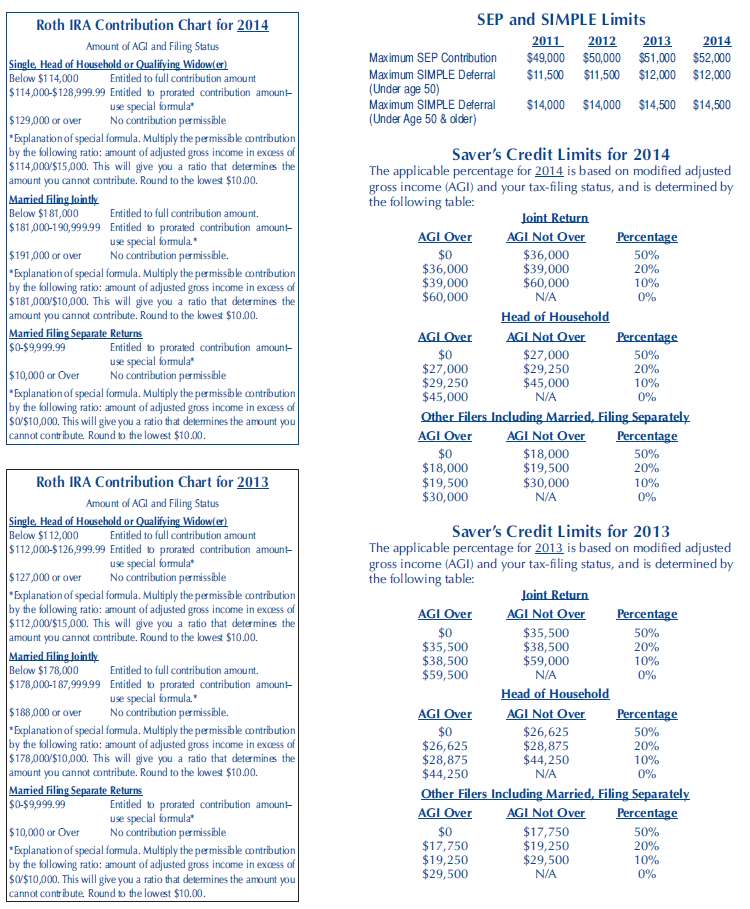

IRA Contribution Limits for 2014 - Unchanged at $5,500 and $6,500

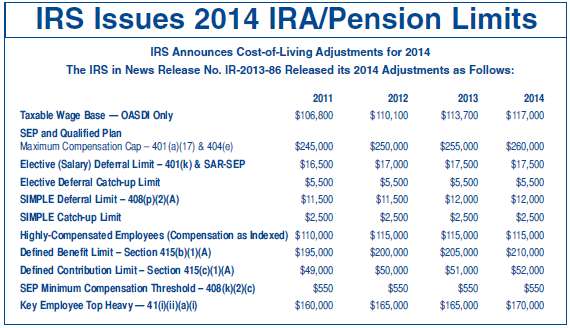

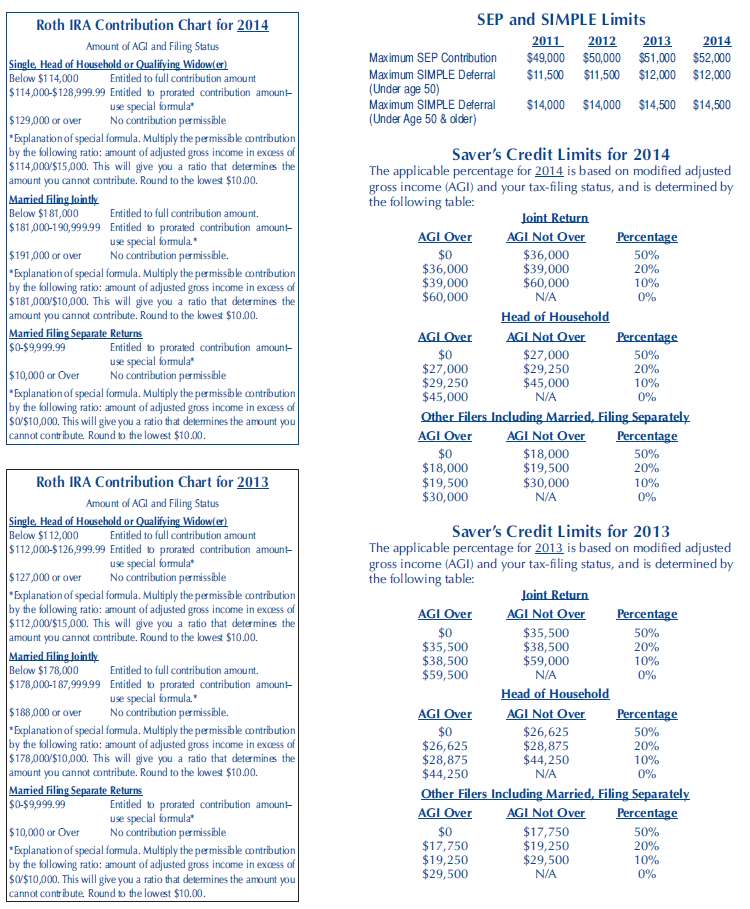

e 16-day government shutdown impacted the IRS. The IRS reopened on October 17. On October 31 the IRS released the 2014 IRA and pension limits. Inflation was very low for the fiscal quarter ending September 30, 2013, so many of the IRA and pension limits as adjusted by the cost of living factor have not changed or the changes have been quite small.The maximum IRA contribution limits for 2014 for traditional, Roth and SIMPLE IRAs did not change – $5,500/$6,500 and $12,000/$14,500 respectively.

The maximum contribution limit for SEP-IRAs is $52,000 for 2014 up from $51,000 for 2013.

The maximum limits for 401(k) participants for 2014 are also unchanged at $17,500/$23,000.

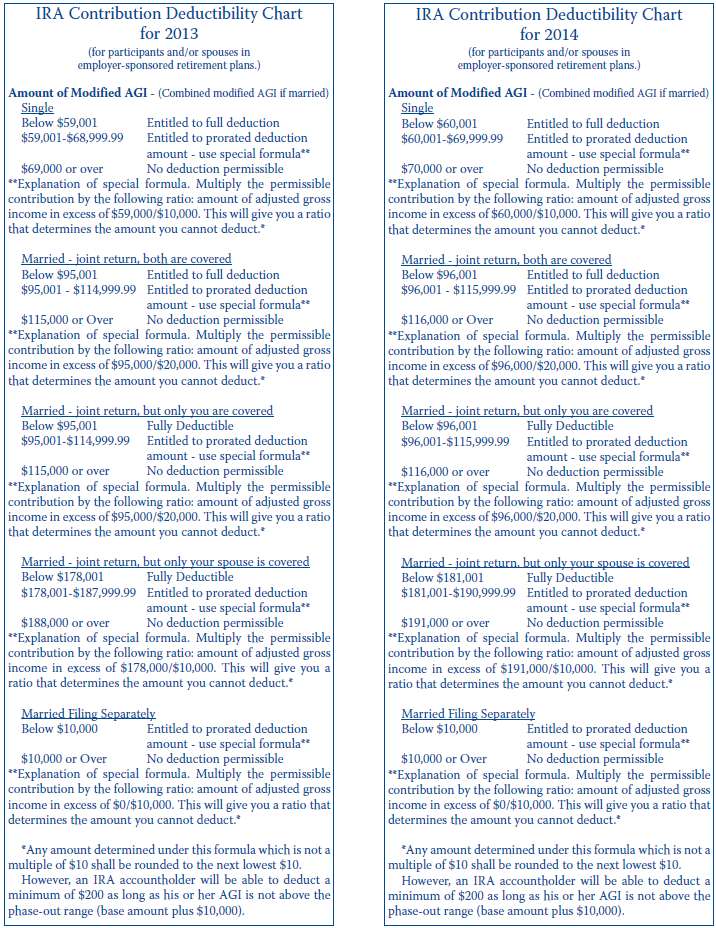

The IRA compensation limit changes were small, either $1,000 or $3,000.

Contribution limits for a person who is not age 50 or older.

Edited on: Monday, April 14, 2014 15:50.19

Categories: Pension Alerts