« Military Death Gratuity and Service-members Group Life Insurance Payment and Roth IRAs. | Main | Will the IRS Revise the IRA/Pension Life Expectancy Tables in the Near Future? »

Wednesday, May 15, 2013

IRA Limits for 2013

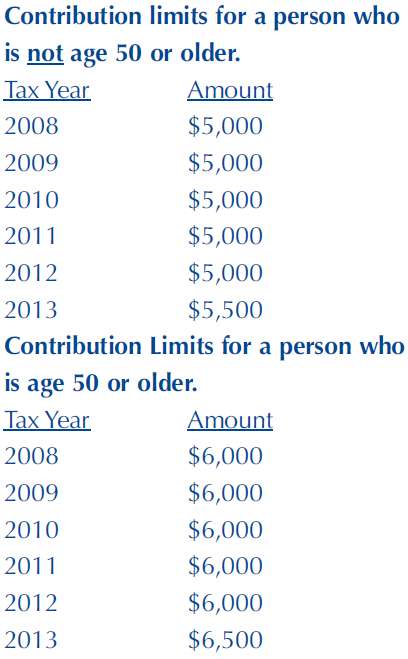

After many years, the maximum IRA contribution limits for 2013 will be $500 larger. For 2008-2012, if a person was not age 50 as of December 31, then his or her maximum contribution was $5,000 assuming he or she had compensation of at least $5,000. This limit increases to $5,500 for 2013. For 2008-2012, if a person was age 50 or older as of December 31, then his or her maximum contribution was $6,000. This limit increases to $6,500 for 2013. The annual catch-up contribution limit for individuals age 50 or older remains at $1,000. Hopefully, contributions for 2013 will be larger than those for 2012 and end the recent decrease in IRA contributions.

Edited on: Monday, April 14, 2014 15:42.28

Categories: Pension Alerts, Traditional IRAs