« February 2014 | Main | September 2013 »

Friday, January 24, 2014

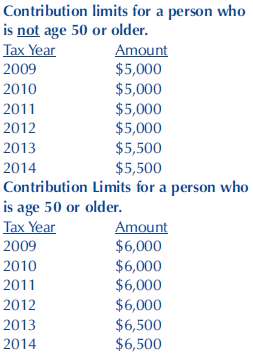

IRA Contribution Limits for 2014 - Unchanged at $5,500 and $6,500

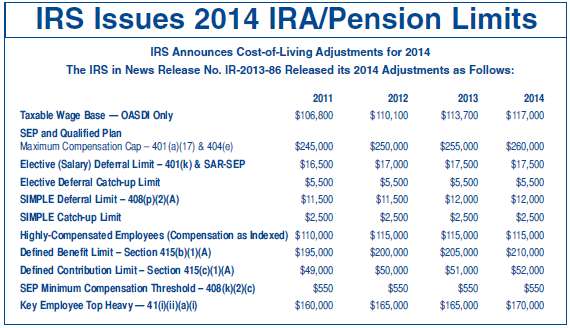

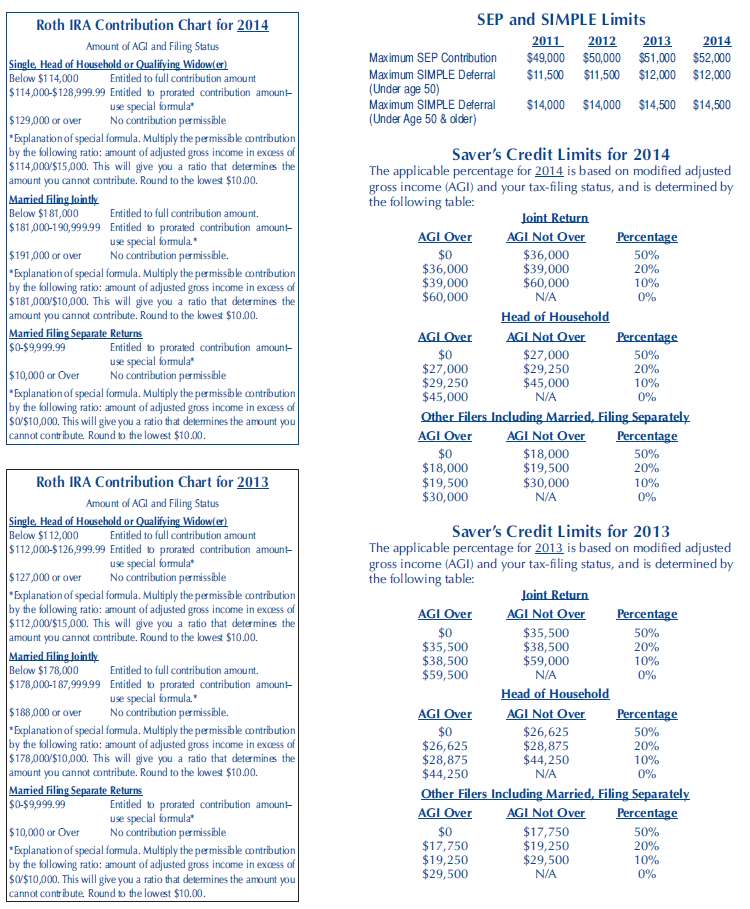

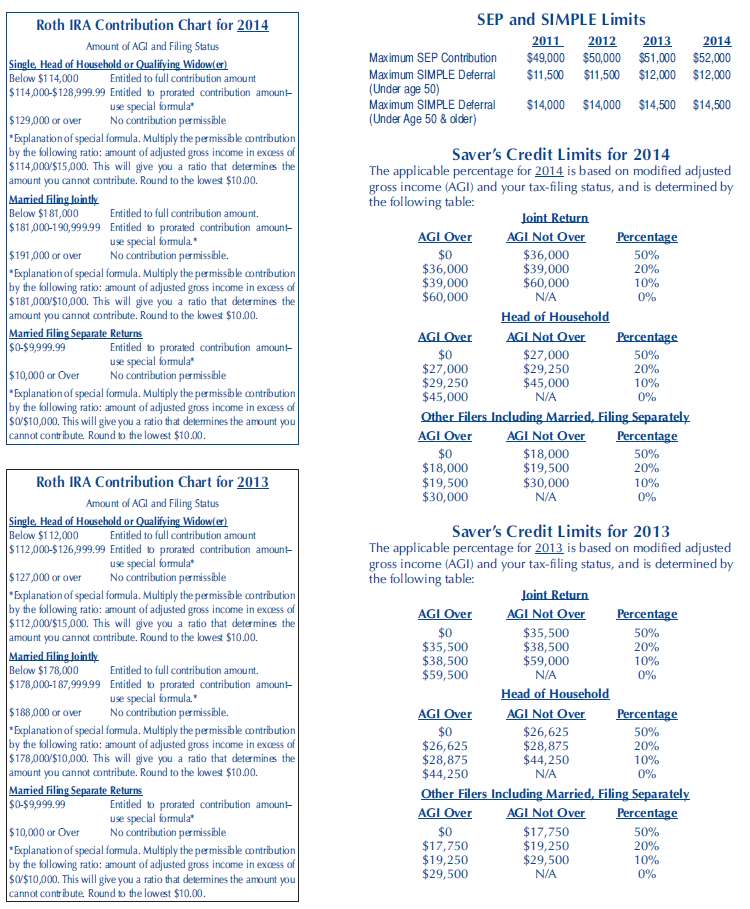

e 16-day government shutdown impacted the IRS. The IRS reopened on October 17. On October 31 the IRS released the 2014 IRA and pension limits. Inflation was very low for the fiscal quarter ending September 30, 2013, so many of the IRA and pension limits as adjusted by the cost of living factor have not changed or the changes have been quite small.The maximum IRA contribution limits for 2014 for traditional, Roth and SIMPLE IRAs did not change – $5,500/$6,500 and $12,000/$14,500 respectively.

The maximum contribution limit for SEP-IRAs is $52,000 for 2014 up from $51,000 for 2013.

The maximum limits for 401(k) participants for 2014 are also unchanged at $17,500/$23,000.

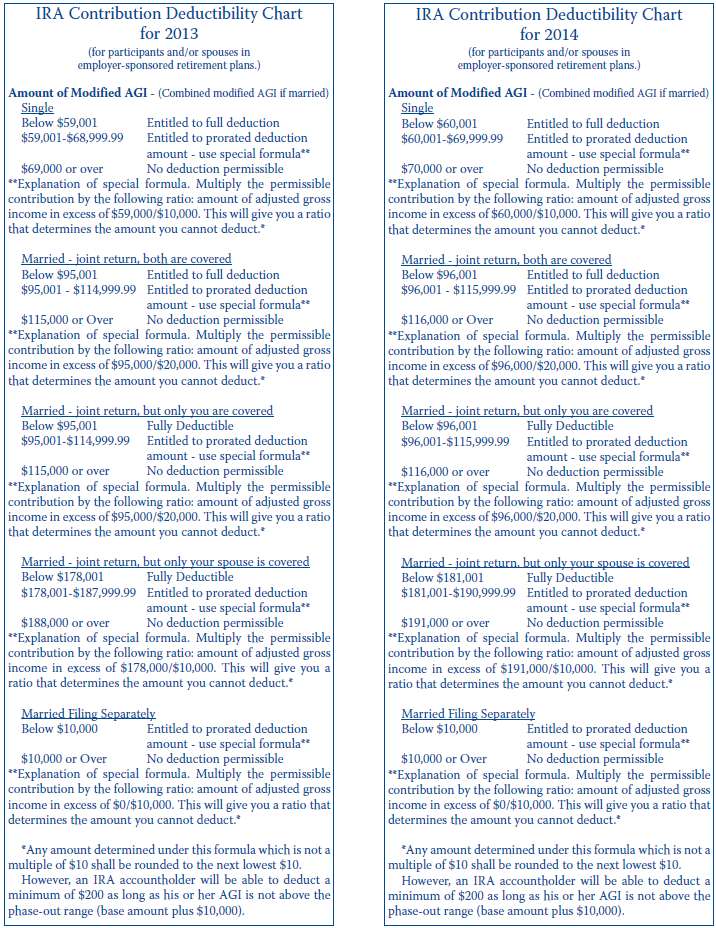

The IRA compensation limit changes were small, either $1,000 or $3,000.

Contribution limits for a person who is not age 50 or older.

Edited on: Monday, April 14, 2014 15:50.19

Categories: Pension Alerts

Friday, January 10, 2014

Faulty IRA Information – Roth IRA Article From Certain Investment Firm and the Two Roth IRA 5-Year Rule(s)

IRAs hold over 27% of all retirement plan assets in the United States. People are and should be writing about IRAs. Some articles, including brochures, will sometimes contain errors. A certain investment firm has recently sent a fax to some financial institutions discussing Roth IRAs and some incorrect statements were made. Your institution may have been sent the fax.

November and December are month when some traditional IRA owners decide they are going to do a Roth IRA conversion. Within this article we do not directly name the investment firm, but it is a major firm. The main error within the article is to state that there is always a separate 5-year time period for each distinct Roth IRA conversion contribution.

Why this newsletter article? Many times a CWF client will call us and ask, “why does this article state the tax rules differently than what you have previously told us?”

CWF’s answer is, let us review what you are reading and let us make a determination if we are wrong in our understanding of the tax rules or if the investment firm is wrong?

There are actually two 5-year rules which may apply to a Roth IRA distribution. You, your customer, and their advisors want to understand both rules.

The first 5-year rule relates to whether the distribution of income from a Roth IRA will be taxable or not taxable. There is only one 5-year time period for this 5-year rule.

The second 5-year rule relates to whether a person who is under age 59½ when he or she does a conversion will owe the 10% additional tax if he or she takes a subsequent withdrawal from the Roth IRA before he or she has met a second 5-year requirement. For this purpose, there is a 5-year time period determined for each conversion. When a person under age 59½ does a conversion, he or she does NOT owe the 10% additional tax as generally applies when a person is not yet age 59½.

If there was no requirement to leave the converted funds in the Roth IRA for a certain time period after the conversion, any person under age 59½ who wanted to take money from his or her traditional IRA would first convert it to a Roth IRA and then take the distribution from the Roth IRA to avoid the 10% tax.

The lawmakers could have decided on any time period: 3-years, 6-years, 10-years, but 5-years was selected. Having two different 5-year rules is confusing.

The 10% additional tax is not owed by a person who has done a conversion once he or she attains age 59½ or meets the 5-year rule with respect to that particular conversion. For example, a person who is age 57 at the time of the conversion is subject to the 5-year rule and also the 10% additional tax for any distribution he or she would take between age 57 and 59½. The 10% tax is not owed once a person attains age 59½.

Below are various incorrect statements made in the article:

“Unlike the 5-year rule that applies to contributions, the 5-year rule applies to each conversion separately; each conversion has it’s own 5-year waiting period before a qualified distribution may occur.” These two statements are categorically incorrect.

Error #1. The 5-year rule does NOT apply to each conversion separately. Reg. 1.408A-6, Q/A-2 provides there is only one 5-year period for both annual and conversion contributions. The IRS regulation provides, “The 5-taxable year period begins on the first day of the individual’s tax year for which the regular contribution is made to any Roth IRA of the individual or, if earlier, the first day of the individual’s tax year in which a conversion is made to ANY Roth IRA of the individual. The 5-taxable year period ends on the last day of the individual’s fifth consecutive tax year beginning with the tax year discussed in the preceding sentence.”

Error #2. The article states the the 5-year rule applying to “annual” contributions is different from the 5-year rules applying to a conversion contribution. The regulation indicates the 5-year period may be different, but it need not be. For example, a conversion made on December 2, 2013, means the 5-year period begins on January 1, 2013 whereas an annual contribution made on March 1, 2014, for 2013 will also have a 5-year period which begins on January 1, 2013

“Recharacterization is only available in connection with converting amounts into a Roth IRA. It is not available for conversions within a qualified plan.” This is not well-written. It is true a qualified plan participant who converts taxable funds into a Designated Roth account cannot recharacterize such conversion. However, the first sentence is wrong because a person is permitted to recharacterize an annual contribution by going from a traditional IRA to a Roth IRA or going from a Roth IRA to a traditional IRA.

The statement is also made that “IRA conversions can be recharacterized up to October 15 of the year following the conversion.” Not everyone qualifies for this extended deadline. The actual law is, a person has until April 15 of the following year to recharacterize a contribution (be it a conversion or an annual contribution). However, if a person filed his or her tax return by April 15 and paid any tax owing, then he or she is given until October 15 to complete the recharacterization.

CWF’s explanation is consistent with IRS guidance as set forth in the Regulation 1.408(A) and IRS Publication 590. See Q&A’s 2 and 5 of the regulation. Any article on Roth IRA distributions should explain that the law mandates that distributions come out in the following order: annual contributions, the conversion contributions in order of time (oldest come out first), and then earnings come out last. A person never owes income tax when he or she withdraws a contribution (annual contribution or a conversion contribution) because such contributions were made with after-tax funds.

A person never owes income tax when he or she withdraws the income or the earnings and the distribution is “qualified.” A person does owe income tax on the earnings when he or she withdraws the earnings and the distribution is NOT qualified (e.g. not 59½ or 5- year rule not met). And if this person is under age 59½, he or she will owe the 10% additional on such earnings.

In summary, the investment firm’s Roth IRA article contains a number of errors. In 1999 the law was changed so that there is only one 5-year time period for purposes of determining whether nor not a Roth IRA distribution is qualified (tax-free) or not. Believe it or not, everyone should congratulate the lawmakers as they did try to simplify the tax calculation. The original law effective only for 1998 would have required a person to have separate 5-year time periods for Roth IRA conversion contributions versus annual Roth IRA contributions for purposes of whether the income was taxable or not.

Edited on: Monday, April 14, 2014 15:50.45

Categories: Pension Alerts, Roth IRAs

Be Aware - Rolling Over an Old Keogh Plan Into an IRA May Lead to Serious Tax Problems

Your financial institution may have a customer who wants to rollover to an IRA an old Keogh that he or she has at another financial institution. Or, such customer may have the old Keogh at your institution. An institution wants to understand the tax laws applying to this situation so that it can decide what course of action should be adopted.

A number of banks in 2013 called CWF regarding a customer wanting to rollover an old Keogh plan; we know some banks will call us in 2014. An old Keogh plan is one which the customer did not update as the tax laws required. For example, the customer’s most recent plan document was last updated in 1987, 1991, 1994, 2001, etc. Plans which once were Keogh plans in the 1970’s generally became profit sharing plans in the 1980’s and later.

A person or business which established and maintained an old Keogh or profit sharing plan received substantial tax benefits. First, the sponsoring business, including a one person business, was allowed to claim a tax deduction for the contribution amount. The current maximum contribution for 2013 is $51,000 and is $52,000 for 2014. Second, the earnings on the contributions are not taxed until distributions commence. When a distribution occurs (actual or deemed), the amount withdrawn is in included in income and is taxable. When a plan document in not updated by an applicable deadline, the amount in the old Keogh or profit sharing plan is deemed distributed. This is true whether the individual knew of the deadline or not. The individual should have paid tax on this amount and an additional 25% tax is imposed when a person understates his or her tax liability.

The individual is NOT entitled to resolve his or her tax problems by rolling such funds over into a traditional IRA. Distributed qualified plan funds are eligible to be rolled over into an IRA only if the funds are distributed from a “qualified” plan. A plan which has not been timely updated is no longer qualified.

The IRS has a special correction program called Employee Plans Compliance Resolution System (EPCRS). The IRS has adopted this tax administrative program to promote voluntary compliance with the tax pension rules. The concept is – an employer which has not complied with certain tax rules is able to pay a modest compliance fee and modify the plan so there is now compliance. If this is done, the IRS will treat the plan as qualified so that a distribution will be able to be rolled over.

The IRS compliance fee for not updating a plan document is in the range of $375-$750 if the plan covers less than 20 participants. The employer or the employer’s representative must make a special IRS filing. CWF’s fee to prepare such a filing would be in the range of $500- $1,500 as these filings are very time consuming. It normally takes 6-15 hours to prepare the necessary IRS filing materials.

As you would expect, individuals in this situation may not be inclined to pay the IRS $375-$750 and certainly do not want to pay an attorney or accountant $500- $1,500. From CWF’s position, these individuals should jump at the chance to get tax relief by paying relatively modest amounts. An individual with a non-updated Keogh or profit sharing plan with $100,000 might well be required to pay $30,000-$65,000 in taxes, penalties and interest should the IRS discover his or her non-compliance.

For this reason, one would think a person paying $1,000-$2,000 to resolve the situation is more than reasonable and is a prudent thing to do. Many people, however, don’t think this way. They don’t want to pay the IRS anything and they may learn a tax lesson the hard way.

What if the old Keogh funds were located at another financial institution, the individual has withdrawn the funds, and he wishes to make a rollover contribution into his IRA?

If a financial institution has information showing that the purported rollover is ineligible to be rolled over, it must not accept the contribution. A nonqualifying rollover contribution is an excess IRA contribution and a 6% excise tax will apply each year. For example, an individual rolls over $100,000 in December of 2013 even though if he is ineligible to do so. Ten years later the IRS audits this person and discovers the impermissible rollover. Since the $100,000 is an excess contribution, he will be owe $6,000 plus interest and penalties for each of the ten years. If the financial institution has no information showing that the plan is “old” and if the individual completes a rollover certification form, the rollover contribution may be accepted.

What if the old Keogh funds have been located at your financial institution, but the plan was not updated when it should have been?

A financial institution was and is allowed to discontinue its sponsorship of a Keogh or profit sharing plan document. As long as the the institution gave the individual notice that it would no longer be providing this service and would assist with a transfer to another financial institution, such institution should have no liability. You may inform the individual about EPCRS.

If the financial institution may have some responsibility for the individual not updating his plan, then the financial institution and the individual should make a EPCRS filing to correct the situation. The two parties would need to decide how the costs would be borne or shared. One can expect the IRS and the bank regulators would impose substantially harsher tax and banking consequences if the sponsoring business has knowledge of plan errors and does not choose to use the correction methods which are available.

Update on Profit Sharing Prototypes. The IRS appears to be on schedule to meets its April 1, 2014, deadline for issuing new favorable opinion letters to all prototype mass submitters, including CWF. Then, as in past years a sponsoring employer of a prototype plan is given 12-months in which to amend and restate its plan by completing and signing the updated adoption agreement.

By doing so, the plan is considered to be qualified for the period of 2006-2011/2012.

Edited on: Monday, April 14, 2014 15:51.00

Categories: Pension Alerts