January 2011

As one of the country's leading IRA and Pension Consulting and Service firms, we offer the financial services industry a complete package of IRA and Pension Forms and Support. We promote the interest of the financial institution while at the same time providing a clear explanation of IRAs or HSAs to the individual.

« April 2011 |

Main

Monday, January 10, 2011

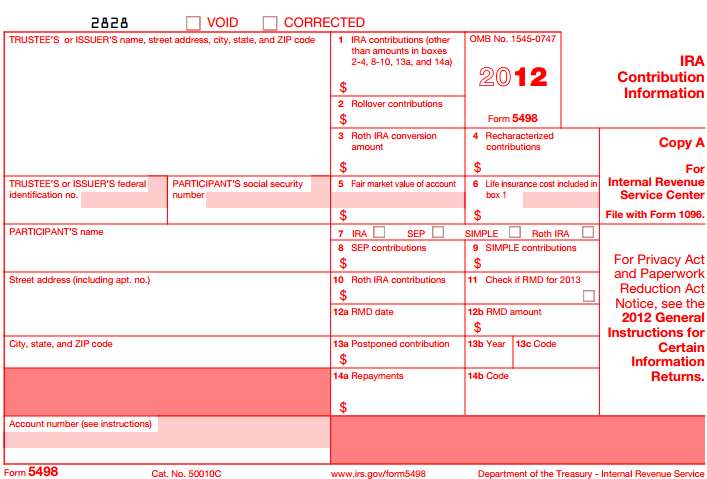

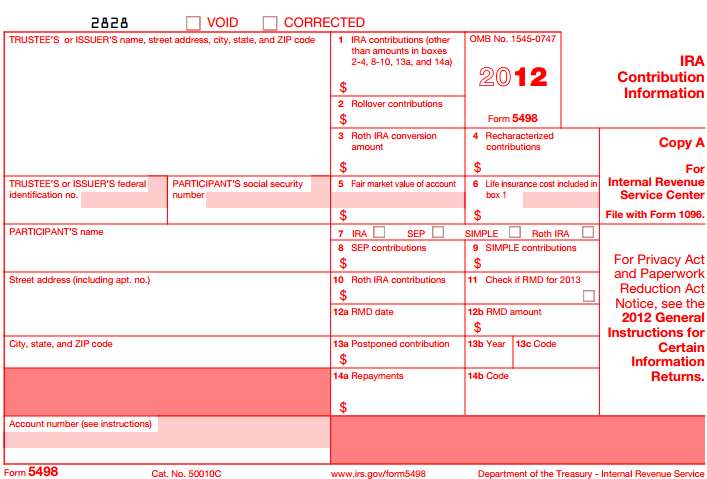

Final Review 2012 Form 5498

-

On the bottom left there is an “Account Number”box. The IRA custodian

is required to insert an account number in this box when filing more

thanone Form 5498 for the same person. If your institution wants to

earn some bonus points with the IRS,you will complete this box even

though it is not required. A unique number should be used. Using such

a number helps the IRS to process corrected information accurately.

The account number may be a checking or savings account number or some

other unique number with respect to an individual. The number must not

appear anywhere else on the form (i.e. it cannot be the social

security number

-

In Box 7 only one of the 4 boxes must be checked to indicate the type

of IRA. A person who has a traditional IRA, SEP IRA and Roth IRA would

need to be furnished three 5498 forms

-

Box 1. IRA Contributions (other than amounts in boxes 2-4, 8-10,

13a and 14a). Enter the amount of the annual contributions made on

or after January1, 2012 through April 15, 2013 as designated for 2012.

The IRA custodian is to report the gross amount of the annual

contributions even if such contributions are excess contributions, or

will be later recharacterized. These are still to be reported

-

A traditional IRA contribution, which is not properly reported in one

of the other traditional IRA boxes as discussed below, is to be

reported in box 1. For example, if a person tries to roll over

$28,000, but does so on day 70 and the IRA custodian learns of this

fact prior to filing the current year’s Form 5498, then the IRA

custodian must report this $28,000 in box 1. This same procedure would

apply if somehow non-IRA funds had been mistakenly transferred into an

IR

-

Box 2. Rollover Contributions. Enter the amount of the rollover

contributions made on or after January 1, 2012 through December 31,

2012. Made means received by the Traditional IRA custodian. Also,

enter those contributions which are treated as a rollover contribution (i.e.

direct rollover). A rollover may either be an indirect rollover or

a direct rollover. An indirect rollover means the paying plan (could

be an IRA or an employer plan) issues the distribution check to the

individual who then makes a rollover contribution by the 60 day

deadline. A 60 day indirect rollover may occur between two traditional

IRAs, two SEP-IRAs, or between a traditional IRA and a SEP-IRA or vice

versa. Remember that nonspouse IRA beneficiaries are ineligible to

roll over a distribution from one inherited IRA and redeposit it into

another inherited IRA. A direct rollover occurs when an employer plan

issues the check to the IRA custodian on behalf of the individual. By

definition, a direct rollover cannot occur between IRAs. Employer plan

means a qualified plan, section 403(b) plan or a governmental section

457(b) plan. The funds attributable to a nonspouse beneficiary of such

plans are eligible to be directly rollover to an inherited IRA and

would be reported in Box 2

-

Box 3. Roth IRA Conversion Amount. This box will be completed when a

conversion contribution is made to a Roth IR

-

Box 4. Recharacterized Contributions. The IRSinstructions are very

brief, “Enter any amounts recharacterized plus earnings from one type

of IRA to another.” If a person had made either an annual contribution

or a conversion contribution to a Roth IRA in either 2011 and/or 2012,

he or she may elect to recharacterize it as adjusted by earnings or

losses to be traditional IRA contribution in 2012. The total amount

recharacterized is to be reported in box 4. Although the IRS

instructions use the term, “plus earnings”, the IRS should use the

term, “plus or minus earnings or losses.

-

Box 5. Fair Market Value of Account. The IRSinstructions for this box

are also very brief, “Enter the FMV of the account on December 31.”

The IRS added a caution to self-directed and trust IRAs as follows:

“Trustees and custodians are responsible for ensuring that all IRA

assets (including those not traded on established markets or with

otherwise readily determinable market value) are valued annually at

their fair market value.” The instruction to report the FMV as of

December 31 applies whether there is a living IRA accountholder or an

inheriting IRA beneficiary. If the IRA accountholder or inheriting

beneficiary is alive as of December 31, the individual closed his or

her IRA during the year by taking a total distribution and he or she

made no “reportable contribution”, then the IRA custodian is not

required to prepare and file the Form 5498. However, if the IRA

accountholder or inheriting beneficiary died during the year, the IRA

custodian will need to prepare a final Form 5498 for the deceased IRA

accountholder or inheriting beneficiary as discussed below.With

respect to a deceased accountholder or a deceased inheriting IRA

beneficiary, the IRS gives the IRA custodian two options. Option #1 -

report the FMV as of the date of death. Option #2 - report the FMV as

of the end of the year in which the decedent died. This alternate

value will usually be zero because the IRA custodian will be reporting

the end of year value on the Form 5498’s for the beneficiary or

beneficiaries. If Option #2 is used, the IRA custodian must inform the

executor or administrator of the decedent’s estate of his or her right

to ask for the FMV as of the date of death. If the IRA custodian does

not learn of the individual’s death until after the filing deadline

for the Form 5498 (i.e May 31), then it is not required to

prepare a corrected Form 5498. However, an IRA custodian must still

furnish the FMV as of the date of death if requested to do so

-

Box 6. Life Insurance cost included in box 1. An IRA custodian will

normally leave this box blank or will insert a 0.00 since it is only

to be completed if there was a contribution to an IRA endowment

contract as sold by an insurance company a long time ag

-

Box 8. SEP Contributions. Any SEP contributions made to the IRA

custodian during 2012 are to be reported in box 8. Such contributions

could have been for 2011 or 2012

-

Box 9. SIMPLE Contributions. Any SIMPLE-IRA contributions made during

2012 are to be reported in box 9. Such contribution could have been

for 2011 or 2012

-

Box 10. Roth IRA Contributions. Any Roth IRA contributions for 2012

are to be reported in box 10 as long as made between January 1, 2012

and April 15, 2013

-

Box 11. Check if RMD for 2013. An IRA custodianis required to check

this box if the IRA accountholder attains or would attain age 70½ or

older during 2013. The instructions do not discuss whether or not this

box is to be checked for an inheriting traditional IRA beneficiary. It

should not be checked for an inherited IRA. Completing this box is

necessary only if the IRA custodian is required to prepare a 2012 Form

5498 for a person. This box is not checked with respect to an

individual who died during 2012 and who would have attained age 70½ or

older during 2013 had he or she lived

-

Boxes 12a (RMD date) and 12b (RMD Amount). An IRA

custodian’s use of these two boxes is optional, it is not mandatory.

Under current IRS procedures, the IRS does not require the traditional

IRA custodian to furnish it with the RMD amount. The law is unsettled

whether or not the IRS has the legal authority to require that an IRA

custodian furnish the RMD amount. Since the IRS would like to be

furnished this information, the IRS has added boxes 12a and 12b to the

Form 5498. The approach adopted by the IRS is that a traditional IRA

custodian by completing boxes 11, 12a and 12b on the Form 5498 and

furnishing it to the IRA accountholder will meet the requirement that

it must furnish a RMD Notice by January 31. The IRS instructions do

permit the IRA custodian to furnish a separate Form 5498 with the only

information being furnished is the information for boxes 11, 12a and

12.

-

Box 13a. Postponed contribution(s). Since we arediscussing

completing the Form 5498 for a traditional IRA, we will discuss what

needs to be done for postponed contributions to a traditional IRA. The

individual will instruct you on an IRA contribution form the “prior”

year or years for which he or she is making the postponed

contribution(s). The individual must designate the IRA contribution

for a prior year to claim it as a deduction on the income tax year.

Postponed contributions may be made by individuals who have served in

a combat zone or hazardous duty area or individuals who are “affected

taxpayers” due to federally designated disasters. If the IRA custodian

will report the contribution made after April 15 and the individual

designates a contribution for a prior year, then the IRA custodian

must prepare either (1) a Form 5498 for the year for which the

contribution was made or (2) on a Form 5498 for a subsequent year.

Under approach #1, the IRA custodian may choose to report the

contribution for the year it is made. For example, if an individual in

September of 2012 designated a contribution of $5,000 to a traditional

IRA for 2010. The IRA custodian could choose to prepare a 2010 Form

5498 and report the $5,000 contribution in box 1. If the IRA custodian

had not prepared a 2010 Form 5498 for this individual, the IRA

custodian then would prepare an original 2010 Form 5498. If the IRA

custodian had previously prepared a 2010 Form 5498 for this

individual, the IRA custodian then would prepare a “corrected” 2010

Form 5498. Under approach #2, if the the IRA custodian is furnished a

contribution after April 15, the IRA custodian may choose to report it

on that year’s Form 5498. The amount of the contribution must be

reported in box 13a and the year for which the contribution was made

in box 13b and in box 13c the applicable code as follows: AF - Allied

Force EF - Enduring Freedom or IF - Iraqi Freedom FD - Affected

taxpayers of designated disaster area. Definition. An individual who

is serving in or in support of the Armed Forces in a designated combat

zone or qualified hazardous duty area has an additional period after

the normal contribution due date of April 15 to make IRA contributions

for the prior year. The period of time is the time the individual was

in the designated zone or area plus at least 180 days

-

Box 14a. Repayments. A traditional IRA accountholder who has taken a

distribution under special disaster rules or who has taken a qualified

reservist distribution is eligible to repay the distribution even

though such repayment does not qualify as a rollover. Enter the amount

of the repayment(s). Box 14b. Code. Enter the applicable code

for the type repayment(s): QR - repayment to a qualified

reservist DD - repayment of a federally designated disaster

distribution. Note that repayments only have one reporting procedure

whereas postponed contributions have two reporting procedures

-

Duty To Prepare/Furnish Corrected Form 5498. An IRA custodian is

required to prepare a corrected form 5498 as soon as possible after it

learns there is an error on the original form as filed. The IRS

furnishes the following example. “If you reported as rollover

contributions in box 2, and you later discover that part of the

contribution was not eligible to be rolled over and was, therefore, a

regular contribution that should have been reported in box 1 (even

if the amount exceeds the regular contribution limit), you must

file a corrected For 5498.

Posted by

James M. Carlson at

14:42.24

Edited on: Monday, April 14, 2014 15:54.30

Categories:

January 2011

| Sun | Mon | Tue | Wed | Thu | Fri | Sat |

|

|

|

|

|

|

|

1

|

|

2

|

3

|

4

|

5

|

6

|

7

|

8

|

|

9

|

10

|

11

|

12

|

13

|

14

|

15

|

|

16

|

17

|

18

|

19

|

20

|

21

|

22

|

|

23

|

24

|

25

|

26

|

27

|

28

|

29

|

|

30

|

31

|

|

|

|

|

|

Archives

Categories

Credits